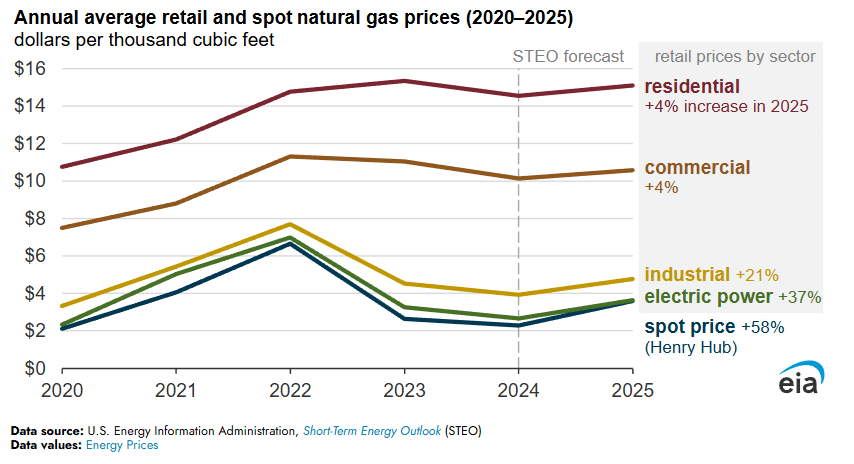

US retail natural gas prices have risen in 2025, driven by higher wholesale prices, though the impact varies by sector. Electric power and large industrial customers are seeing the largest increases—37% and 21% respectively—closely tracking Henry Hub spot prices, while commercial and residential prices are rising more modestly at 4% due to slower utility rate adjustments and regulatory limits. Retail prices for smaller customers also include fixed delivery and customer charges, which dampen the effect of wholesale price changes. Overall, the 2025 Henry Hub spot price is projected to be 58% higher than in 2024, underpinning sector-specific retail price growth. The EIA writes:

Driven by an increase in wholesale natural gas prices, retail U.S. natural gas prices for every sector have increased so far this year, although the increases are uneven across sectors. In our latest Short-Term Energy Outlook, we expect the 2025 annual average price of natural gas paid by electric power plants to increase by 37% and the price paid by industrial sector customers to increase by 21% compared with the 2024 averages. We forecast that natural gas prices for customers in the commercial and residential sectors will increase by less, at 4% each.

Each sector’s price is partially affected by the wholesale price of natural gas, as represented by the spot price at the Henry Hub benchmark. So far this year, monthly Henry Hub natural gas prices have been higher than in the same month in 2024. On an annual average basis, we expect the 2025 Henry Hub natural gas price to be 58% more than it was in 2024.

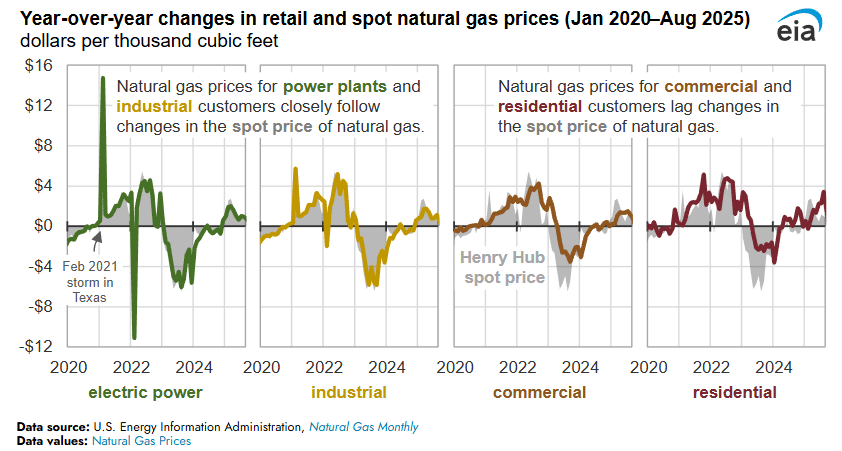

The wholesale price of natural gas more directly affects prices for industrial and electric power consumers of natural gas. In those sectors, the year-over-year changes in retail natural gas prices closely follow the year-over-year changes in the natural gas spot price at Henry Hub. Large industrial and electric power customers typically purchase natural gas on a wholesale basis that includes basic commodity and transmission costs.

In our natural gas industry surveys, we do not survey prices directly but rather derive sector-level prices from utility revenues and sales volume. These retail prices reflect what end-use consumers pay for natural gas.

Delivered natural gas prices for residential, commercial, and smaller industrial customers do not track wholesale spot prices as closely because utilities adjust consumer rates gradually through billing cycles, which are sometimes governed by regulatory processes that limit price increases.

For these customers, wholesale natural gas prices are a smaller portion of the retail price, further limiting the extent to which wholesale prices affect retail prices. The prices these customers pay also reflect customer charges and fixed charges associated with transportation and distribution.

Read more here.