You might as well throw darts at the financial pages. To Burton Malkiel, who authored the book A Random Walk Down Wall Street, picking stocks is about randomness. He believes that all knowable information is priced into stocks and bonds when you buy them.

I’ve been reviewing my sixth edition of Random Walk from 1996, which has cover art showing a dart stuck into the financial pages. In Malkiel’s view, a rising tide lifts all ships. Yet he covers much more than that view over the book’s 522 pages.

What isn’t helpful is that investors read his op-ed promoting his latest edition (the 10th, 2011) and think the coast is clear for whatever he’s recommending without reading his book. I believe based on anecdotal evidence that investors use his endorsement and invest more money than they can afford to lose—a bad four-letter word, especially in retirement. That’s why his most recent op-ed recommending muni bonds makes me nervous.

In his op-ed in The Wall Street Journal last week called “The Bond Buyer’s Dilemma,” Malkiel wrote:

The fiscal problems of state and local governments are well known, and the parlous state of municipal budgets has led to very high yield spreads on all tax-exempt bonds. Many revenue bonds with stable and growing sources of revenue sell at quite attractive yields relative to U.S. Treasurys.

For example, the New York/New Jersey Port Authority gets reliable revenues from airports, bridges and tunnels to support its debt. Long-term N.Y/N.J. Port Authority bonds currently yield close to 5%, and they are free of both federal and state and local taxes in the states in which they operate.

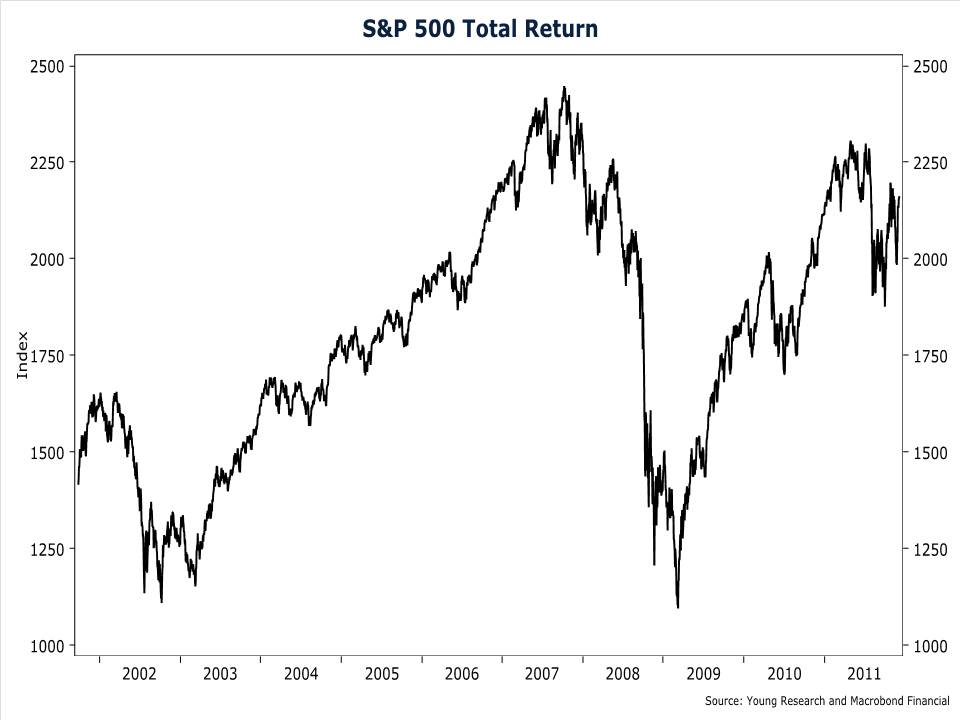

I pulled out the folder I keep on Malkiel to reread his op-ed from September 26, 2001, called “Don’t Sell Out,” written days after 9/11. It was the right advice for the time—not only for investors but for the country. But the thrust of the piece depended on the notion that stocks were cheap on a relative P/E basis. He wrote, “Some investors fret that stocks are still over-priced, despite the recent sell-off. But a study of P/E ratios suggests the market is fairly valued.” With the benefit of 20/20 hindsight, you can see for yourself the returns in subsequent years on my chart of the S&P 500 Total Return.

Warren Buffett has made a pretty good living proving markets are not as random as Malkiel’s theory. Obviously he’s got a slight advantage over you or me. But with the bailout of Goldman Sachs, he played the role of the market and set the pricing by acting as the lender of last resort. His stock-picking record compares quite well to the random walk over the last 10 years.

The sixth edition of Random Walk preceded the tech bubble. The seventh edition preceded the real-estate bubble. I wonder now with the 11th printing if we’re not about to see the bursting of the government bubble.