On January 31, the world’s largest bank will default on its obligations. The somewhat tragically named 2010 China Credit-Credit Equals Gold #1 Collective Trust Product bonds issued by Industrial and Commercial Bank of China, the world’s largest bank by deposits, will not be repaid in full. Without a bailout, this will turn into China’s first major default according to Reuters:

ICBC, which marketed the product without providing any formal guarantee against default, said on Thursday that it would not bear the “main responsibility” for repaying investors.

China has not suffered a large-scale public default as yet because local governments and state banks have stepped in with bail outs.

Last year, trust loans accounted for 11 percent of overall corporate fundraising, central bank data shows, and a default could spark a domino effect if investors lost confidence.

A sudden pullback in financing from trusts and other wealth management products would hurt weak borrowers like local governments and real estate developers, who struggle to access traditional bank loans.

Alarm bells first rang over the trust loan to Shanxi Zhenfu Energy Group Ltd when a vice chairman of the coal company was arrested for accepting deposits without a banking licence.

China Credit Trust last year warned investors that Shanxi Zhenfu Energy Group Ltd. had taken out high-interest underground loans totaling 2.9 billion yuan, bringing its total liabilities to 5.9 billion yuan and threatening its ability to repay the trust loan.

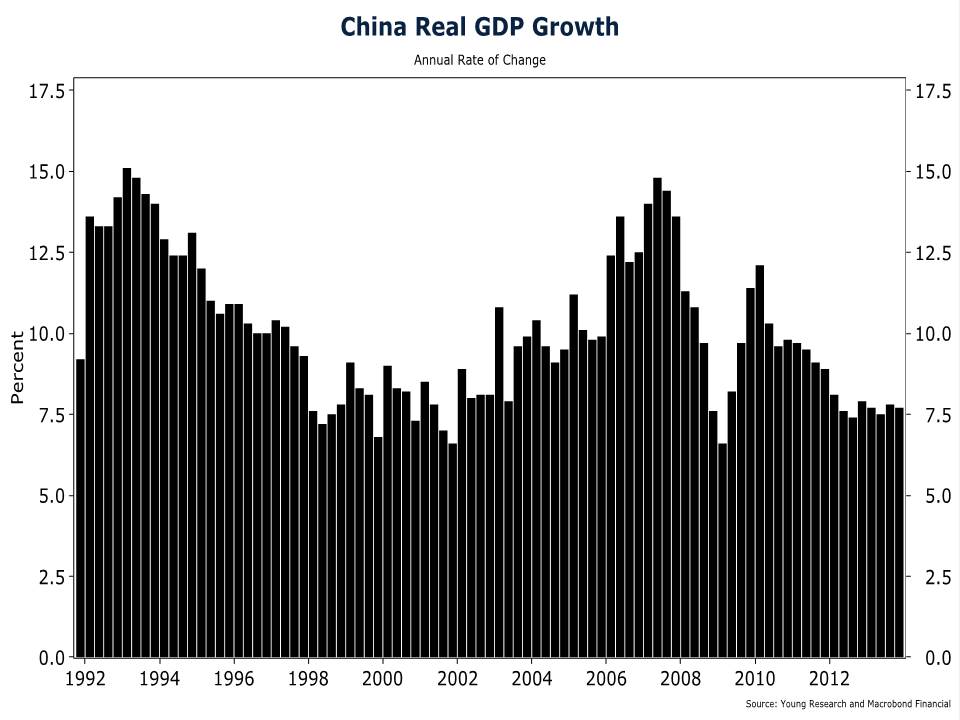

The rapid increase of debt creation in China is having adverse effects on the nation’s growth. The chart below shows China’s decelerating GDP growth.

According to the Financial Times, this rapid debt growth could lead to a major bust.

One of the biggest worries for Chinese policy makers has been the rapid increase of debt, much of it channeled through a loosely regulated shadow banking system.

After holding steady at about 130 per cent of GDP for most of the 2000s, total debt in the Chinese economy began to soar after the 2008 financial crisis and reached more than 200 per cent by the end of 2013.

Increases of this magnitude have proved precursors to financial crises in other economies, and Beijing is expected to take stricter measures to rein in credit.

We have advised extreme caution in investing in China for some time. Continue to be cautious in the Middle Kingdom.

UPDATE: Help is on the way. No details as to who is providing the bailout/buyout, but some generous organization has stepped in to bailout ICBC.