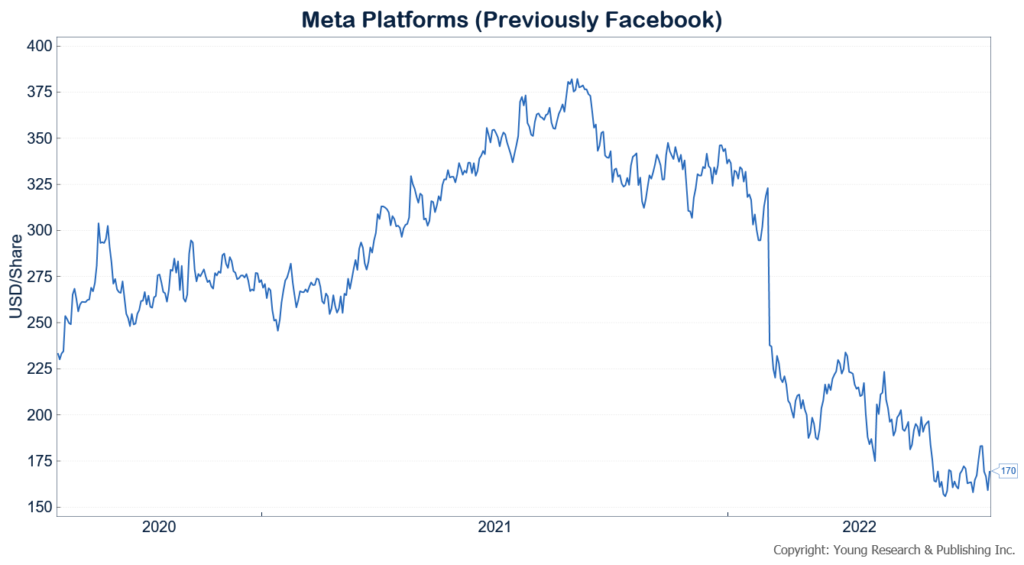

Investors are not happy with Meta, the parent company of Facebook, Instagram, WhatsApp, and other ventures. The report showed that Meta suffered its first-ever revenue drop in a quarter during the Second Quarter of 2022. Salvador Rodriguez reports for The Wall Street Journal:

Facebook parent Meta Platforms Inc. posted its first decline in revenue and issued a muted outlook on digital advertising as it contends with growing competition from rival TikTok.

The company reported quarterly revenue of $28.8 billion, down almost 1% from a year earlier and slightly below the $28.9 billion Wall Street was expecting. It marks the first time that the company has posted a quarterly drop in revenue from the year earlier.

“We seem to have entered an economic downturn that will have a broad impact on the digital advertising business,” Chief Executive Mark Zuckerberg said Wednesday. “It’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago,” he said on an earnings call.

Meta is grappling with a digital advertising market in upheaval from surging inflation and other factors that are causing a slowdown in ad spending. Google parent Alphabet Inc. on Tuesday reported the slowest rate of growth since the second quarter of 2020, when the pandemic crimped demand for advertising in some areas. Rival Snap Inc. reported its weakest-ever quarterly sales growth last week while Twitter Inc. reported a decline in revenue.

Meta also disclosed that Facebook’s daily active user base rose to 1.97 billion users. The figure was 1.96 billion three months ago. The increase defied expectations of analysts surveyed by FactSet who thought user numbers would fall.

The company posted a net profit of $6.7 billion for the second quarter, the third quarter in a row Meta’s bottom line has fallen. The company hasn’t experienced such a slump since the fourth quarter of 2012.

The weak advertising demand was reflected in Meta’s average price per ad, which fell 14% in the quarter. A year ago, the company reported an increase of 47%, year over year, for its average price per ad.

The company said it continued to face challenges in targeting ads as a result of changes made by Apple Inc. to the iPhone’s operating system. Chief Operating Officer Sheryl Sandberg, on her last earnings call before she departs Meta after 14 years, said the company is adapting its business to do better ad targeting—with less user data—with products such as click-to-message ads, which open a chat with a business whenever a user clicks on the ad.

Read more here.