We have commented thoroughly on the stimulus programs being signaled or implemented in the United States and Europe, but market speculation has broadened its horizons. Now anticipation of stimulus efforts from developing countries is moving prices. Speculators saw the weak foreign trade data announced Monday morning by China as cause for optimism when it comes to the prospect of future fiscal stimulus.

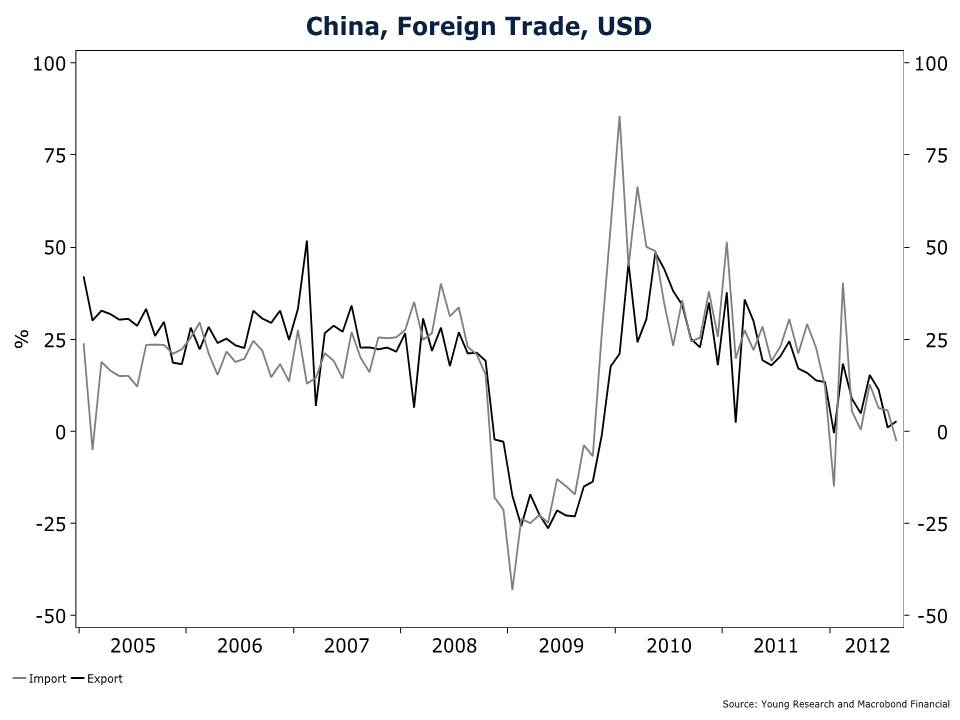

China’s imports declined by 2.7% compared to the year before, and exports only grew at—what is for China—a very modest 2.7% over the year. The average annual growth for imports and exports over the last five years has been 18.4% and 18.7% respectively. As you can see on the chart below, the trend in the growth rates is taking them into territory last seen during the Great Recession. It is certainly possible the government will choose to stimulate (beyond the minor infrastructure program announced last week) to protect its economy from recession.

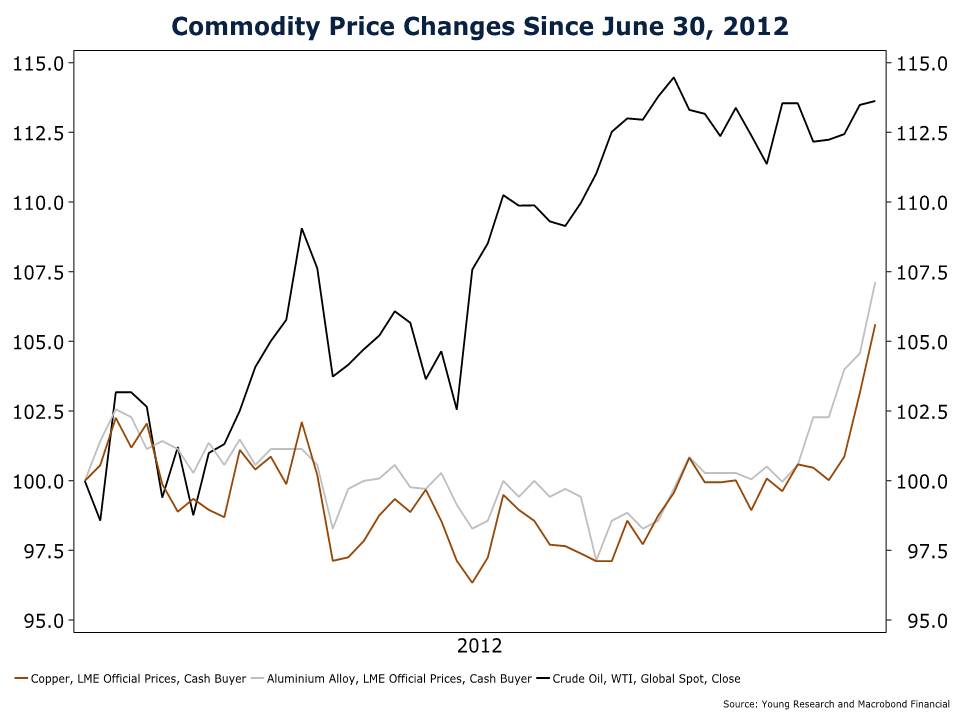

That type of data, coupled with signals from governments’ hints of stimulus, is giving heart to speculators betting on future money printing. In the last week, speculators’ optimism has shown up in the prices of oil, aluminum, copper and other indicators sensitive to stimulus measures. The chart below shows the price action of these commodities since the end of June. In the most recent week, prices for the commodities have surged on news of the European plan for unlimited money printing, continued speculation of a third round of quantitative easing, and the aforementioned Chinese infrastructure program.

Expectations of future stimulus, rather than market fundamentals, seems to be the dominant factor driving prices of assets considered inflation hedges. Markets are not functioning properly, and until central banks and governments back away from chronic stimulus measures, they will not.