By Niall Flinn @ Shutterstock.com

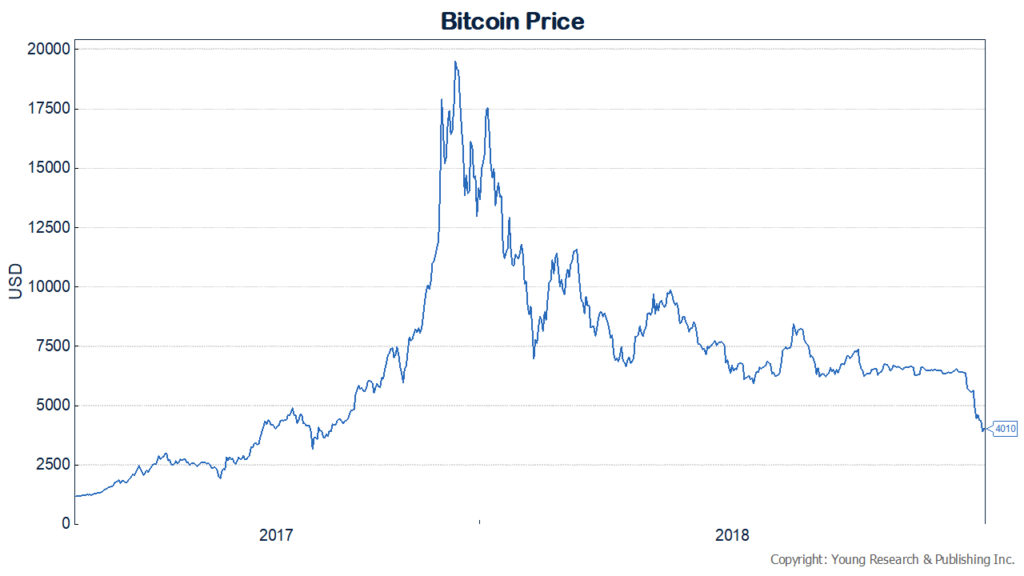

You’re witnessing what happens when markets dry-up as shown here with bitcoin (see chart below). I’ve been warning readers about what George Gilder calls the “cryptocosm.” (Read Parts I, II and III). If you have been hitching your wagon to cryptocurrencies, you might have been enduring a rude awakening this week.

Steven Russolillo, writing at The Wall Street Journal, calls it bitcoin’s “Week from Hell.” He explains

Now, another worry has emerged: Cryptocurrency miners, the outfits that solve complex equations to generate new digital coins, seem to be losing interest. The amount of computing effort expended by miners, known as the hash rate, has started falling.

The hash rate rose for much of the year even as cryptocurrency prices slumped, suggesting people remained optimistic prices would bounce back. But it has fallen sharply in recent weeks, according to Blockchain Ltd., a cryptocurrency-wallet service and data firm. That suggests fewer miners are jumping into the network.

“Bitcoin’s value is always driven by the intensity of demand and supply,” says Edith Yeung, a partner at 500 Startups, an early-stage venture fund. “If the miners stop mining, bitcoin will not function…and the overall market will lose confidence. If there is no confidence, people will freak out and sell even more.”

Rival digital currencies such as ripple and ether have also fallen sharply. The total market value of cryptocurrencies stands at about $130 billion, down from a record high above $800 billion in January, according to research site CoinMarketCap.

The sour mood stands in contrast to a year ago, when cryptocurrencies captured the imagination of individual investors as prices skyrocketed.

Mr. Gu, whose blockchain investment fund in Singapore manages about $400 million in assets, is optimistic the market will recover. “Money is made when there is blood in the streets,” he said.

But others say there could still be pain ahead.

“It’s hard to look at the price charts of the big crypto assets and not cringe,” Fred Wilson, a partner at Union Square Ventures in New York and an early bitcoin investor, wrote on his blog. He drew a parallel to the moves seen when the tech bubble burst.

Back then, Amazon.com Inc. lost 95% of its value from December 1999 through October 2001. The online retail giant has long since recovered. “I think things will get worse before they get better,” Mr. Wilson said.

Read more here.

Originally posted on Your Survival Guy.