I want you to visit my series on FIRE, Financial Independence, Retire Early, here:

- Living Your Best Life: FIRE!: Are you familiar with the FIRE movement? You should be, and you will be shortly. And I’m not talking about a fire where, for example, a tree falls in your backyard onto power lines, ripping them down along with a transformer and nearly burning down your house on a quiet afternoon in Newport, RI.

- “Dad, You’re Stressing Me Out” FIRE! (Part II): Living a lifestyle where you spend 50% less than your “normal” spending doesn’t sound like much fun. But that’s exactly what many members of the FIRE movement are doing. FIRE standing for Financial Independence, Retire Early. I’ve been studying this movement big-time, because there’s a lot for you and me to learn by understanding what others are doing.

- “I wish that I could give you something… but I have nothing left” FIRE! (Part III): As you read in my FIRE series parts I and II, the acronym stands for Financial Independence, Retire Early and is as much a mindset as it is a financial plan. Think about what you spend the most money on and you’ll quickly realize some of it can be reduced but a lot of it cannot when you’re in retirement. Chances are you’re out of debt.

- Will You Outlive Your Money? FIRE! (Part IV): In parts, I, II, and III you learned about those who have embraced the FIRE lifestyle—Financial Independence, Retire Early—and the ways it can help you in your own life. One of the things I think you and I will learn from this movement is if it’s truly feasible to live off a portfolio for 60-plus years—a necessity when retiring in one’s early 30s. But this is not your typical set-it-and-forget-it retirement demographic.

- A Scorched Earth Investment Landscape: FIRE! (Part V): “Never forget what I’m telling you here” -Dick Young When it comes to living off a portfolio for a lifetime, the word lifetime can mean different stretches of time for different investors. As you read in parts I, II, III and IV, I’ve been studying the FIRE movement—Financial Independence, Retire Early—to help teach the next generation how to think about money, and to help you think about your retirement.

Action Line: Open an account at Fidelity and catch some FIRE:

The Basics of FI/RE

FI/RE stands for Financial Independence Retire Early. Although some may choose to retire completely, many pursue FI/RE purely for the Financial Independence (FI).

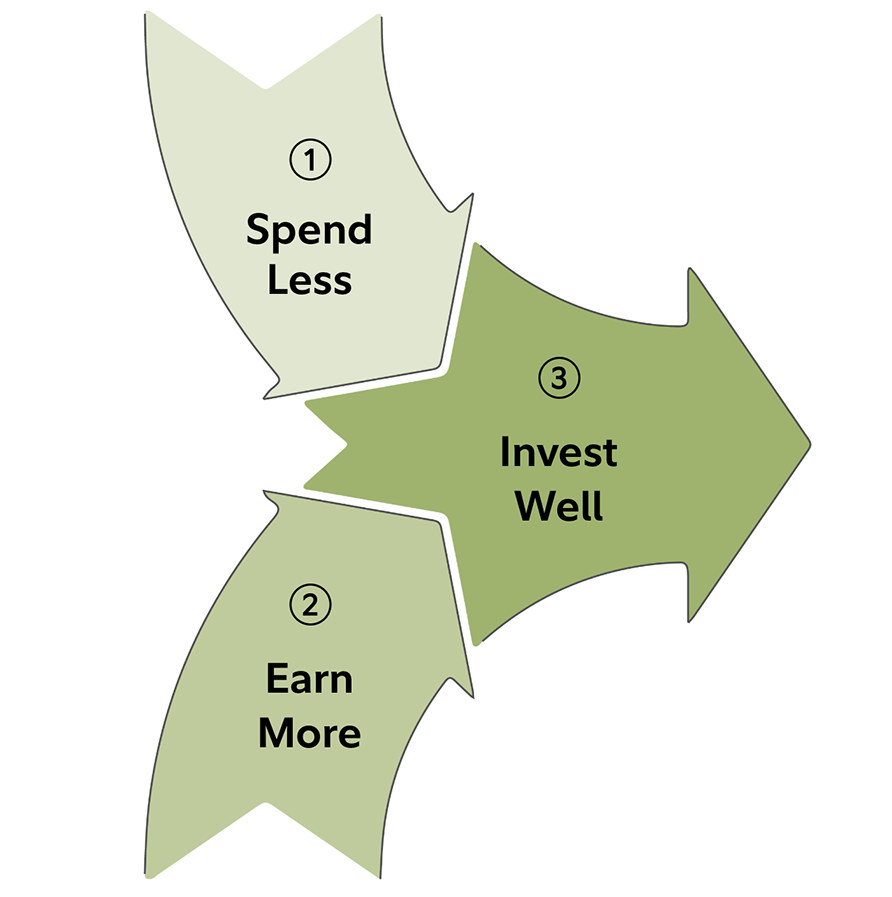

It’s pretty simple. Save as much as you can, and then invest what you save. That way, while you’re working towards your FI goal, your money is also working for you. The sooner you start, the more time your investments have to grow.

- Spend Less – Cut your spending—to find money so you can invest more. We’ll help you find a method that works for you.

- Earn More – Increase your income—you guessed it—so you can invest for your future.

- Invest Well – Investing is the cornerstone of the FI/RE approach. Money in a savings account does not grow the same way that money invested can.

Key Numbers

Savings Rate

Your savings rate is the percentage of your income that you don’t spend. Think of your savings rate as your speed to Financial Independence. Depending on your needs, you can go pedal to the metal or ease off the gas. You’re still on the path even when you need to slow down.

FI Number

Financial Independence can mean different things to different people. Here, when we say Financial Independence, we mean the time when you can cover all of your expenses with income from your investments, rather than from a paycheck. It’s the point where you can work because you want to, not necessarily because you have to. While there is no guarantee, your Years to FI describes how long it may take to get there.

Ready to invest? Fidelity can help!

Fidelity offers tax-advantaged retirement accounts and taxable brokerage accounts, as well as a variety of investment options including index mutual funds (like our Zero expense ratio funds, among others), that can often be part of an FI strategy.

The accounts and products referenced throughout this experience have been chosen in the spirit of the FI/RE movement given their low cost structure and have not been selected based on your personal situation. These may or may not be the right options for you, only you can decide that.

Read more from Fidelity here.

Originally posted on Your Survival Guy.