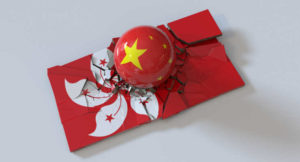

Markets in Hong Kong were hit when the latest Chinese Communist party congress left great uncertainty surrounding the future of business in the city. Hudson Locket and William Langley report for the Financial Times:

Shares in Hong Kong dropped to their lowest level since the end of the global financial crisis as investors reacted to the city’s economic recovery plans and the 20th Chinese Communist party congress in Beijing, where President Xi Jinping is expected to secure a third term.

The benchmark Hang Seng index fell as much as 3 per cent to its lowest level since May 2009, while the China Enterprises index of large mainland companies listed in the city fell as much as 3.3 per cent.

The Hang Seng Tech index was also down as much as 4.8 per cent after the Nasdaq Golden Dragon index, which tracks Chinese tech groups trading in the US, closed trading on Wednesday down more than 7 per cent.

Hong Kong’s equities have underperformed US and European markets this year as geopolitical tension between Beijing and Washington rises. Shares have also suffered from a regulatory assault on the tech industry in China, where a real estate crisis is weighing on economic growth.

Thursday’s declines come after Hong Kong leader John Lee’s inaugural policy address on Wednesday, in which he unveiled measures to attract international business and talent but stopped short of scrapping inbound travel or social distancing restrictions related to the Covid-19 pandemic.

Investors have also been closely watching China’s Communist party congress, which some analysts had hoped might include the announcement of economic stimulus or some easing of Xi’s disruptive zero-Covid strategy.

Dickie Wong, head of research at Kingston Securities in Hong Kong, said many traders had been betting that Lee would announce substantial relief measures for the city’s embattled property market but were disappointed.

“Basically there were no new substantial measures [on real estate],” Wong said, adding the negative market sentiment was compounded by Beijing’s decision to delay the publication of China’s third-quarter economic growth readings this week.

“This creates uncertainty,” he said. “No matter how the economy performed in the third quarter, investors still want a clear picture.”

Read more here.