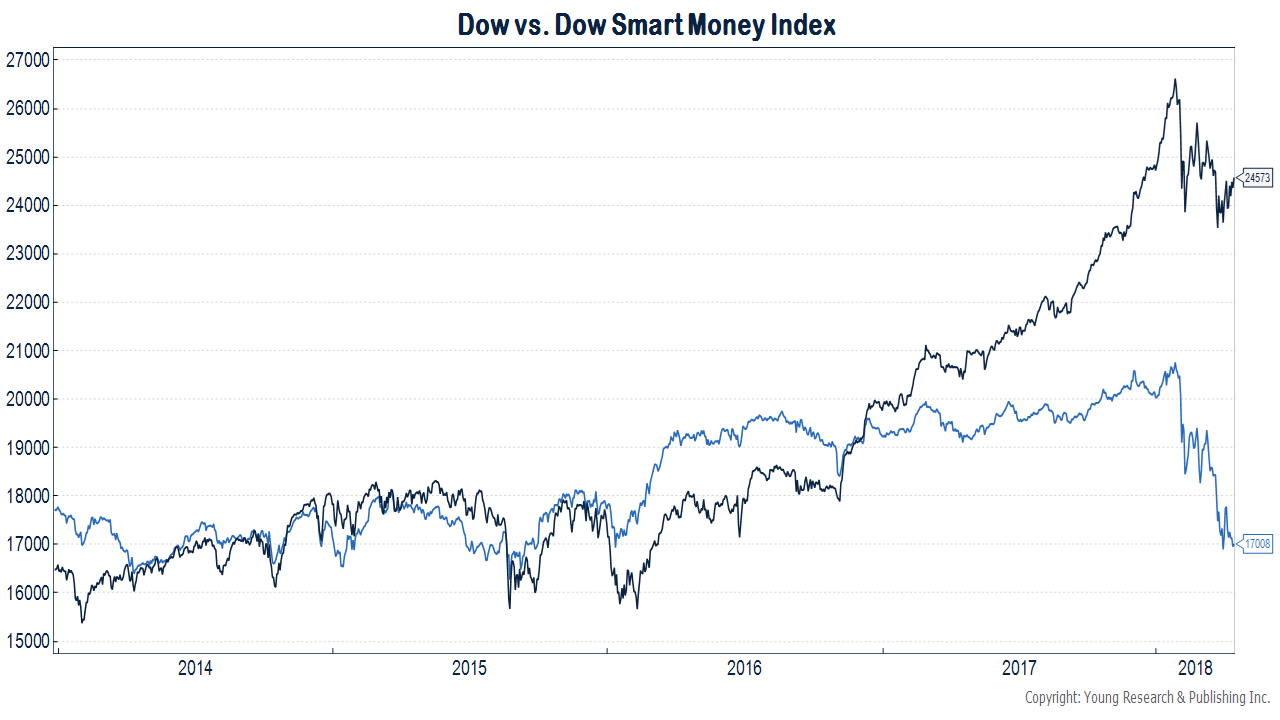

Is the Smart Money Index sending a signal of caution? While the Dow has rebounded from its lows, the Smart Money Index hasn’t been able to stage a sustainable rally. The Smart Money Index measures the performance of the market at the start of trading and the end. The “smart money” is believed to trade more heavily at the end of the day. The index isn’t infallible, but the big divergence between the Dow and the Smart Money Index isn’t a bullish signal.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023