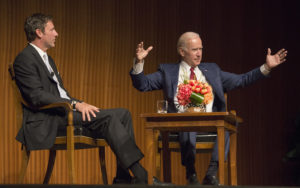

Joe Biden, the 47th vice president of the United States, was the featured guest for the Tom Johnson Lectureship at the LBJ Presidential Library on Tuesday, Oct. 3, 2017. The conversation was moderated by Mark Updegrove, former director of the LBJ Library. 10/03/2017 LBJ Library photo by Jay Godwin

President Joe Biden and Treasury Secretary Janet Yellen are proposing a “global minimum tax” of 21%, and a major increase in the corporate tax in the United States to 28%. The tax increases are expected to “knock 9 per cent off earnings per share for companies in the S&P 500 next year,” according to calculations by Goldman Sachs. Hit especially hard will be communications services and tech, aka the FAANG companies that have been driving growth in the stock market. Aziza Kasmov writes in FT:

Communication services and information technology are likely to be among the biggest losers from the tax package, given the sectors’ exposure to higher taxes on foreign dealings. Goldman expects both to take about a 10 per cent hit on earnings next year owing to the jump in corporate and global tax rates alone. The bank’s estimates were based on a plan set forth during the presidential campaign, which included similar tax increases.

For tech groups in particular, higher taxes are another blow for a sector that, until recently, underpinned an unprecedented rally on Wall Street. Savita Subramanian, head of US equity & quantitative strategy at Bank of America, said tech shares have come under pressure this year from rising borrowing costs, which decrease the value of future cash flows that are heavily baked into the valuations of the sector’s high flyers.

“That suggests to me that these are areas of the markets that are more at risk than they have been for a while,” Subramanian noted.

Read more here.