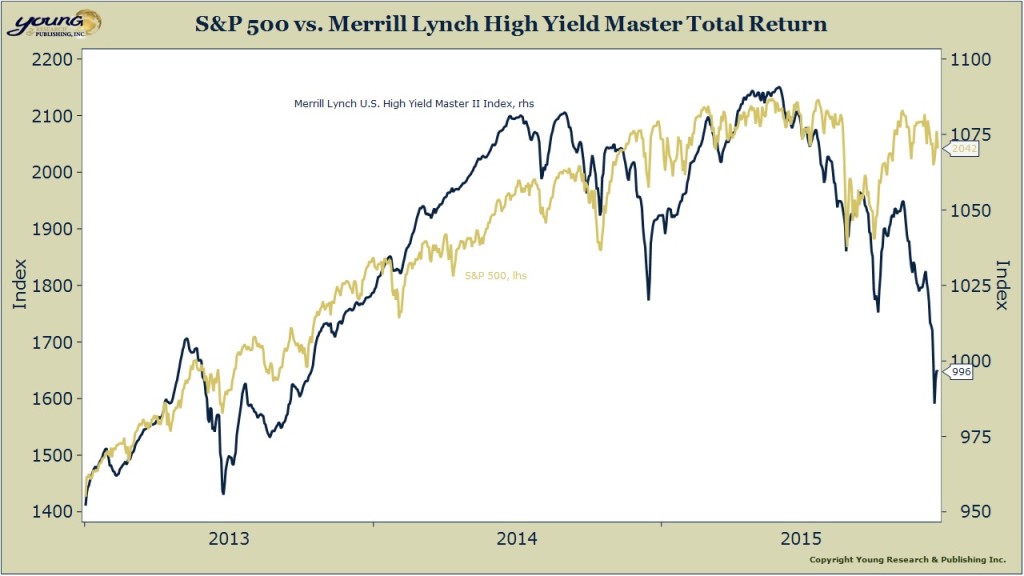

Below you are looking at a chart of the S&P 500 versus the Merrill Lynch High Yield Index. High yield bonds have had a dismal year. The Merrill Index is down almost 10% from its highs earlier this year, while the top heavy S&P 500 is only down a couple of percentage points. Bonds are higher in the capital structure than stocks. In the event of a default, bond holders get their money back before stock holders get a dime. So if investors are selling high-yield bonds because they are concerned about the prospect of default, shouldn’t they also be selling stocks? Historically, big losses in the Merrill high yield index have been associated with even bigger losses in stocks. This time could be different, but those aren’t comforting words in the investment world. Caution remains the watchword.