The Wall Street Journal reports that after the election on November 8, dry bulk shipping companies have seen a surge in share prices. The gains have outpaced expectations, and have left most analysts on Wall St. puzzled.

These wild gains have left analysts scrambling for explanations. It has been a dismal year for dry-bulk shippers, which transport commodities like iron ore across the globe. But the industries woes may have hit bottom. The Baltic Dry Index, a global measure of shipping prices for commodities, has been ticking higher in recent weeks, largely as China stepped up its imports for iron ore, said Magnus Fyhr at Seaport Global Securities in Houston. Still, the sharp, swift gains in these stocks have outpaced analyst expectations.

That’s Not a Typo

In an effort to explain what’s been going on Michael Webber, an analyst from Wells Fargo, penned a report titled Shipping Gets Weird: The Trump Rotation & Retail Momentum. Americanshipper.com writes of the report:

Webber said he has been getting the question “Yo – What The Heck Is Going On?”

“It’s a good question, and one we’ve received quite a bit over the past few days, as the sheer magnitude and velocity of the pricing moves are massive, even by shipping standards,” he said.

Webber said he thinks part of the reason for the move is a continuation of what he calls the “Trump rotation trade – into riskier, energy related assets. We believe the bulk of these moves are general and high level in nature.”

He said retail investors are driving part of the increase, “which has become a self-perpetuating cycle in recent days.”

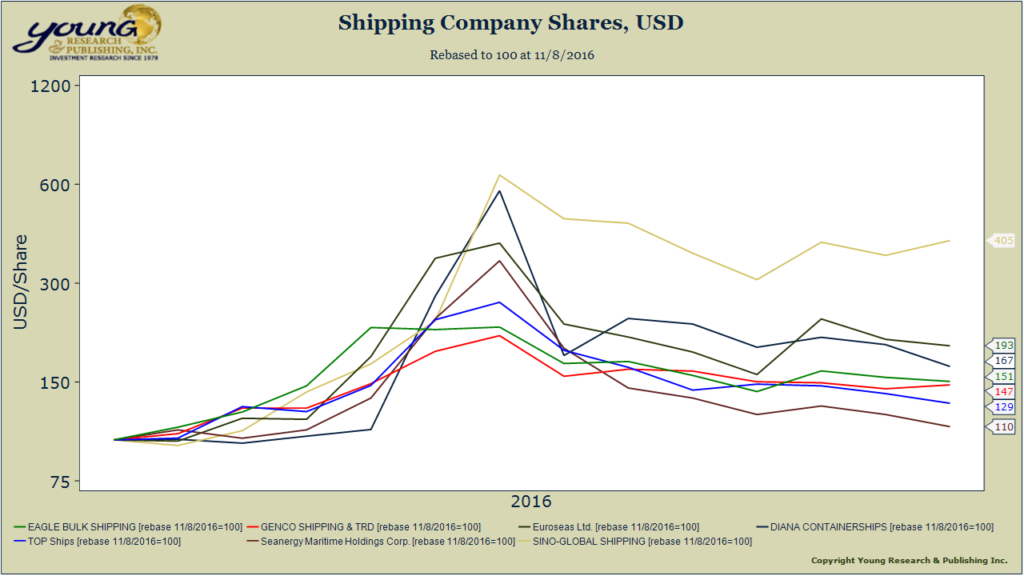

You can see the sharp gains in shipping companies on the chart below. Since the election, every one of these shippers is up double digits, with Sino-Global Shipping up 305% and Eagle Bulk Shipping up 93%. Not on the chart is Dryships, which exploded to an over 1,500% gain in just days after the election. Neck snapping volatility to be sure.