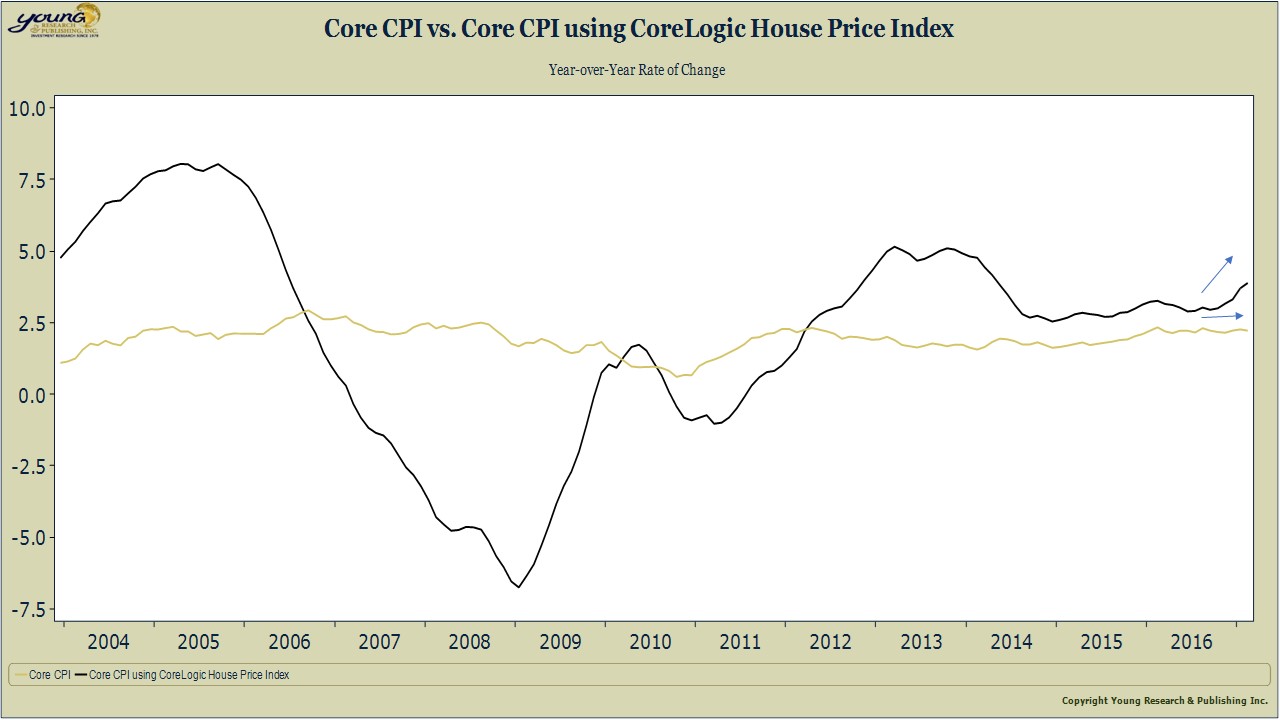

Inflation, or measured inflation for those who take a more skeptical view of the accuracy of the government’s inflation estimates, has been subdued. Core inflation which strips out food and energy is running at 2.20%–slightly ahead of the Fed’s inflation target.

The subdued level of core inflation seems to have led to some complacency in the market. Bond yields and the risk premium for inflation remain near record lows.

But an alternative measure of inflation that takes into account the true cost of home prices instead of the fictional owners-equivalent rent measure used by the government shows that inflation is accelerating. By this measure, core inflation is quickly closing in on 4%.

Which statistic should you believe? Keep a close eye on both. The divergence between the two could be signaling a pickup in measured core inflation to come.