The S&P 500 leapt higher by 3.4% today on yet another plan-to-make-a-plan out of Europe and on news that the Chinese government will boost its stake in the nation’s largest banks. The benchmark index closed above its 50-day moving average for the first time since July. In the span of only five trading days, stocks have gained more than 11%. The sharp end of day bounce off of the 1,074 level last Tuesday, and the follow-through rally, have some technical analysts convinced stocks are poised for an upside breakout—see here. In only one week, the prevailing sentiment on the Street has shifted from despair to euphoria. The high frequency trading algorithms that account for as much as 70% of the daily trading volume apparently cause markets to move much faster these days.

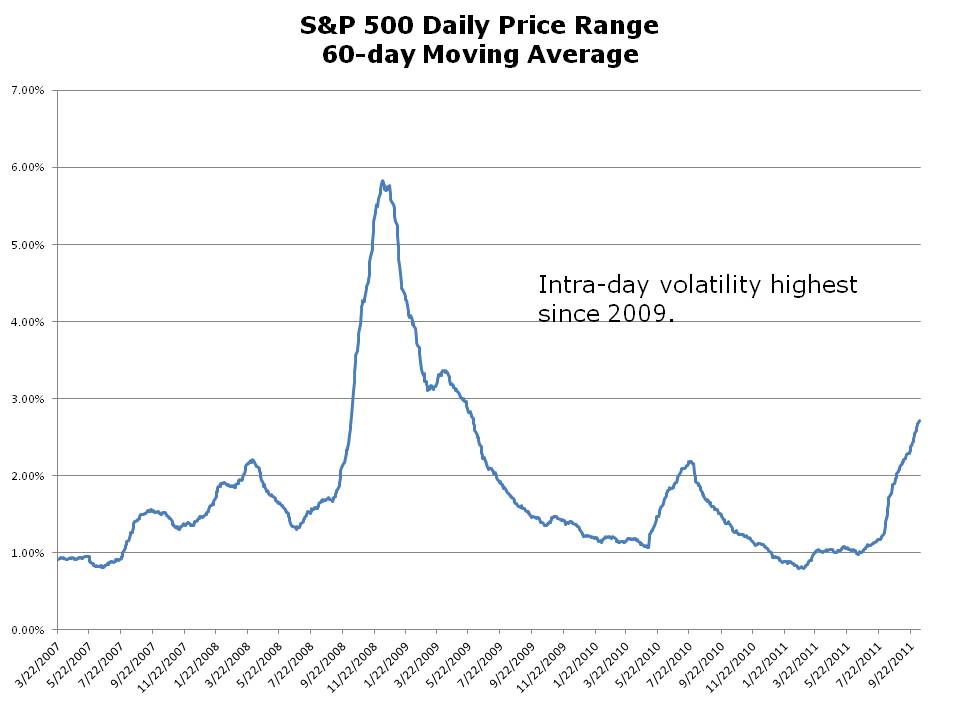

But while traders and speculators may relish the extreme volatility, to the mere mortals among us the neck snapping price movements can be paralyzing. How is one to know if the 11% rally over the last 5 trading sessions will continue or fail spectacularly? The short answer is, of course, you can’t. Stocks are trading in unison on daily news flow. The implied correlation of the S&P 500 has risen to 80—a 45% increase from July levels (100=perfect correlation). Traders and speculators are pushing stocks around on each new rumor of a euro-area bailout or in hope that the Fed will initiate QE3 to prop up the stock market or that Chinese policy makers will bailout the world.

To cope with today’s speculative markets, a defensive approach should be favored. Craft a globally diversified portfolio of stocks and bonds. Invest in companies that have strong balance sheets and operate in industries with high barriers to entry. And most importantly, buy only securities that pay a steady stream of dividends or interest. Cash payments today and the promise of higher payments tomorrow are a soothing tonic for stomach churning volatility.