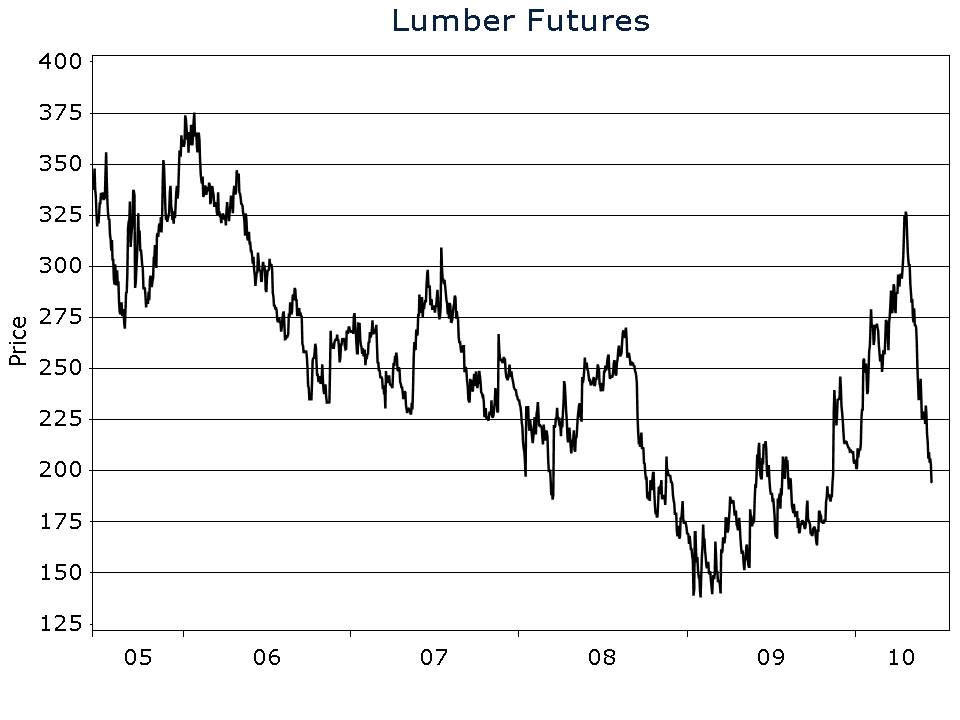

In over four decades in the investment business, I have found that the most reliable economic indicators are not those released by government statistical agencies, but those that are available real-time in the stock, bond, and commodities markets. Three charts I have been monitoring regularly to gauge the strength of the economic recovery are Young Research’s Moving the Goods Index, lumber prices, and copper prices.

Young Research’s Moving the Goods Index is a market-cap-weighted, non-airline transportation index. If the Moving the Goods Index is in a bull market, chances are the economy is gaining momentum. Lumber prices provide a real-time gauge of the strength of the U.S. housing market, and copper, which is said to have a PhD in economics, provides a reading on the strength of the industrial economy.

Today, my three charts show no signs of a sustainable economic recovery. Young Research’s Moving the Goods Index has rolled over and is now in a downtrend. Copper has broken down and looks to be headed for further losses, and lumber prices have cratered. Based on these real-time indicators, the economic recovery is running out of fuel. Inventory restocking is likely to run its course over the coming months, and the pace of stimulus spending is likely to slow. Prudent investors should remain skeptical of the sustainability of the recovery and invest accordingly. I continue to maintain a defensive investment posture and advise the same for my subscribers.