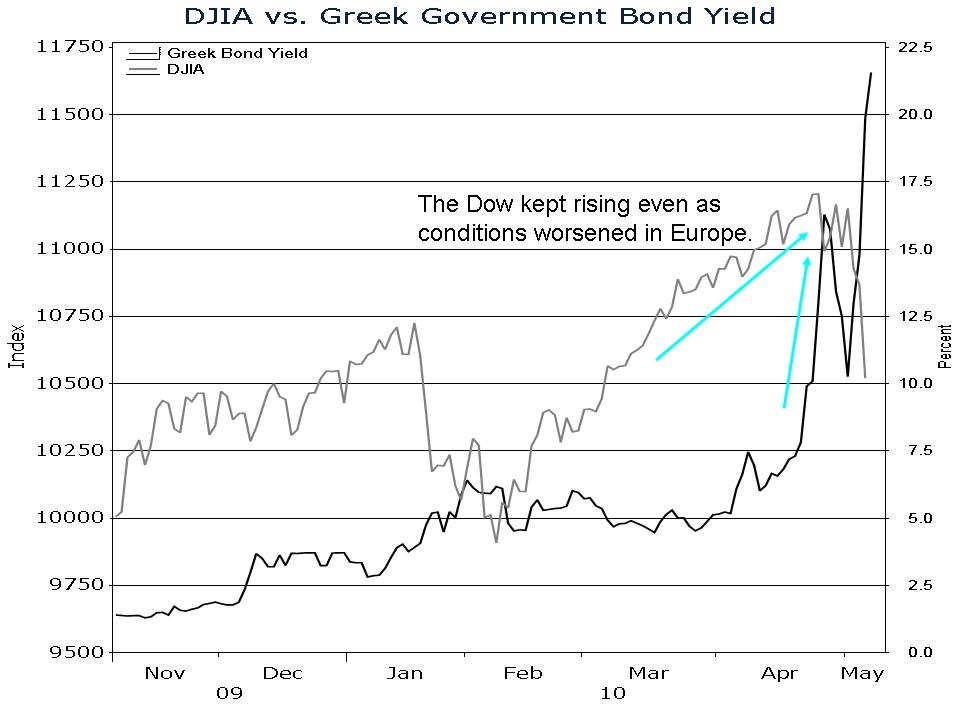

The Dow Jones Industrial Average fell more than 5% this week. Up until this past week, U.S. stocks marched higher despite the increasing risks of a government debt crisis in Europe. This week’s sell-off indicates investors may finally be waking up to the significant headwinds the global economy still faces. If the debt crisis in Greece spreads to other Euro-zone countries, it would wreak havoc on the Euro-zone economy and neighboring countries as well. The global economy would also be impacted. The Euro-zone economy is almost the same size as the U.S. economy. If Europe dips back into a recession, growth in the U.S. is unlikely to remain robust. Lower demand from Europe will ripple through the global economy. I continue to maintain a defensive investment posture and I advise the same for my subscribers.