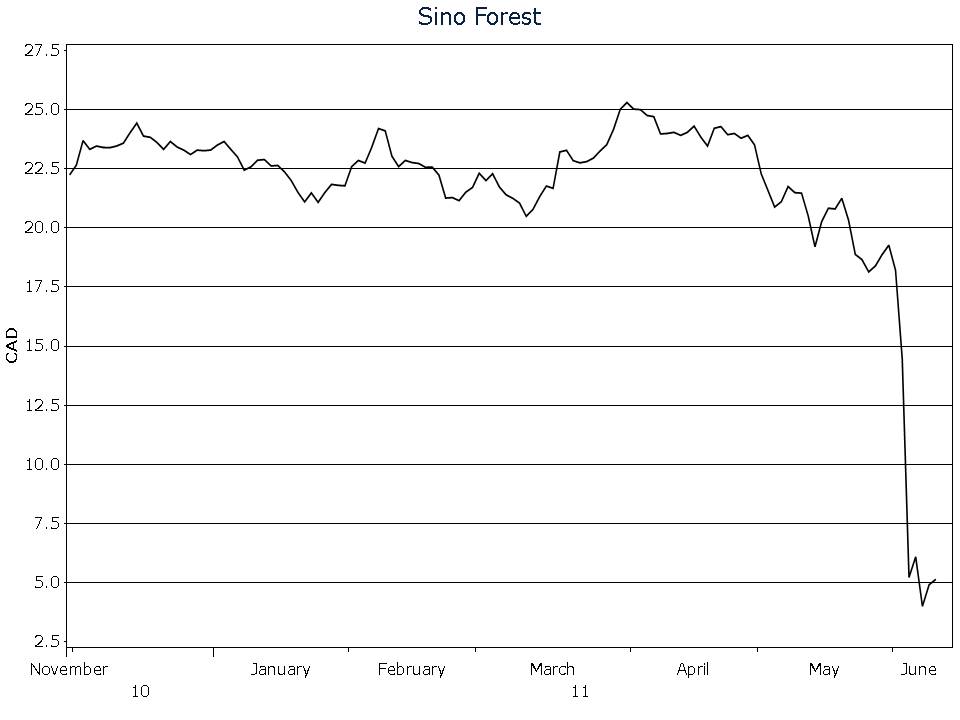

This week, another Chinese company came under scrutiny as possibly perpetrating fraud on its shareholders. Toronto-listed and China-based Sino Forest is under investigation by the Ontario Securities Commission (the SEC’s Canadian counterpart), after a report released by research firm Muddy Waters, accused Sino Forest of “aggressively committing fraud since its RTO in 1995.” The allegations in the Muddy Waters report have been refuted by Sino Forest, but the market smells a rat. Sino’s shares have cratered over 73.3% since the report was released. And we aren’t talking about a penny stock here. Sino had a $6 billion market-cap in April. Its largest shareholder was John Paulson, the venerable hedge-fund manager. Paulson is most famous for making billions by betting against sub-prime mortgages. He’s no amateur.

It shouldn’t come as a surprise that the fraud prevalent in Chinese shares reaches all the way up to large-capitalization stocks. China’s political establishment doesn’t set a good example. Have you ever looked at how China’s economic data is collected and reported? Talk about fraud. If the government isn’t worried about reliable reporting, why should China’s corporate financial managers take a different approach?

At Young Research, we avoid Chinese shares and advise the same strategy for our subscribers.