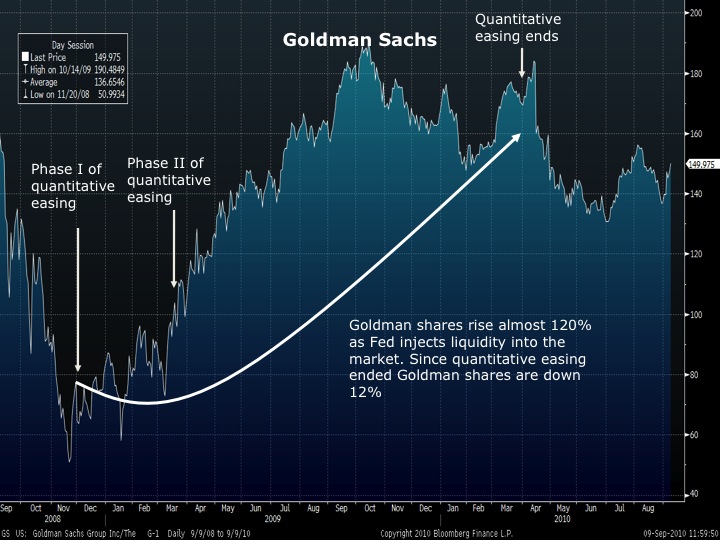

The venerable Goldman Sachs is pounding the table for another round of quantitative easing (QE)—see here. The bank thinks more QE is necessary because the recent slowdown in economic activity is more than a temporary phenomenon. While the economy may be weakening, the efficacy of such a remedy is suspect. Credit conditions are nowhere near distressed, interest rates are at or near record lows, and there is over $1 trillion in excess reserves that lay dormant on bank balance sheets. Another round of QE is unlikely to encourage a sustainable economic recovery. Even Goldman admits as much. The firm’s economic group assumes that another $1-trillion in QE would only boost GDP growth by half a percent. So why would Goldman, and to be fair, many of Wall Street’s big banks, favor such an approach? For the same reason they slap strong buy ratings on companies they bring public. It’s good for business. Quantitative easing inflates asset prices and drives up trading volumes—both are a boon for investment banks. Take a look at my chart on Goldman Sachs. During the first round of quantitative easing, Goldman’s stock price soared 120%. But almost as soon as the Fed stopped quantitative easing, Goldman’s share price declined. Could Goldman and the rest of the Street be genuine in their belief that more QE is necessary? Indeed they could, but based on the Street’s historical record of self-dealing, a healthy amount of skepticism is prudent.