The mainstream press and their liberal Keynesian allies in academia (that means you Princeton & Berkeley) have made a sport out of roasting the Republican led Congress for reining in government spending. Lower government spending, we are told, kills growth at best and crashes the economy at worst.

It is a remarkable feat to argue that bigger government leads to stronger growth when centuries of evidence prove otherwise. Those economies where the share of government is smallest most often are the fastest growing.

Viewed through the lens of Washington insiders, the gridlock and dysfunction that we’ve seen in D.C. over recent years is a negative. Viewed through the lens of the average American, gridlock is an unambiguous positive.

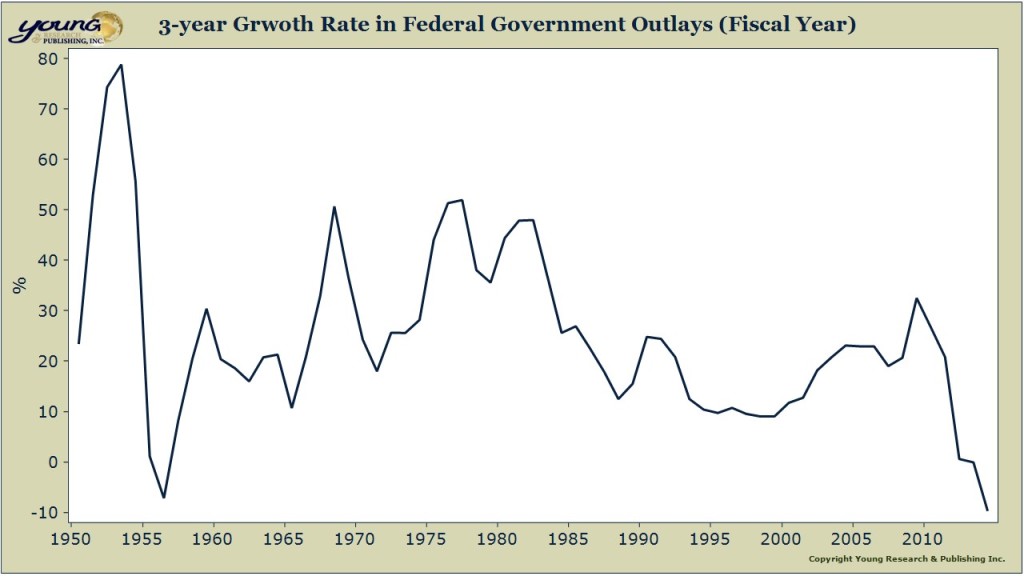

For the three year-period (fiscal years) that the Republicans have had influence over the budget, we have seen an unprecedented reduction in federal spending. The three year growth rate in spending is at a more than six decade low. Granted, Congress was starting from high-base caused by the Obama blow-outs in the early years of his first term, but most often the best Congress can do to rein in spending is to slow the growth rate of spending. This Congress reduced it.

How has the economy performed since? There has been no crash in the economy as some predicted. Unemployment has fallen about three percentage points, economic growth is steady, consumer confidence has soared, and, at least for the time being, the budget deficit is at a manageable level.

Keep this in mind the next time you hear about the need for the government to “stimulate” the economy with deficit spending. The best and most lasting stimulus a government can provide is to reduce the size and scope of spending. The proof, as they say, is in the pudding.