On day one of football training camp, the first lesson many players learn is to play to the whistle. My coach used to drill this into all the new players. He’d say, “I don’t care if the ball is 50 yards downfield, you play full speed until the ref blows the whistle.” When the ball is downfield, the tendency of many players is to jog slowly toward the action until the whistle blows. After all, if you aren’t in the center of the action, what’s the point of playing full speed? That’s an attitude that doesn’t last long. For me, one scrimmage was enough to learn the importance of playing to the whistle. I was jogging downfield toward the end of a play. The next thing I remember, I was flat on my back staring up at the sky. During my leisurely jog downfield, a tackle from the opposing team blindsided me. The hit looked something like this YouTube video (watch the player in the white jersey on the left-hand side of your screen slow down to a jog as the player with the ball is about to get tackled).

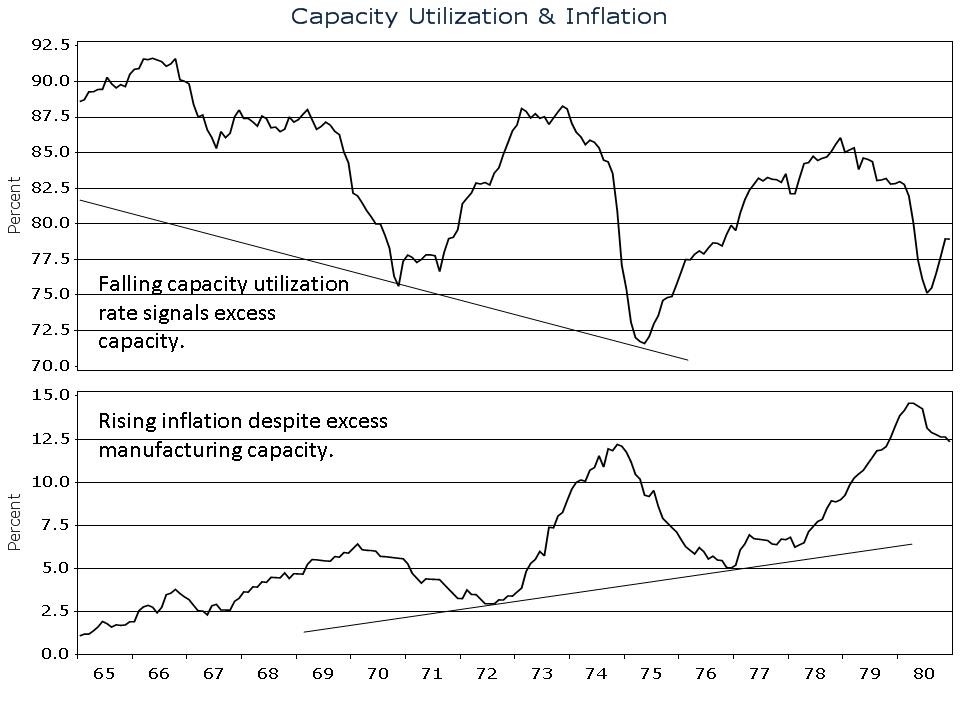

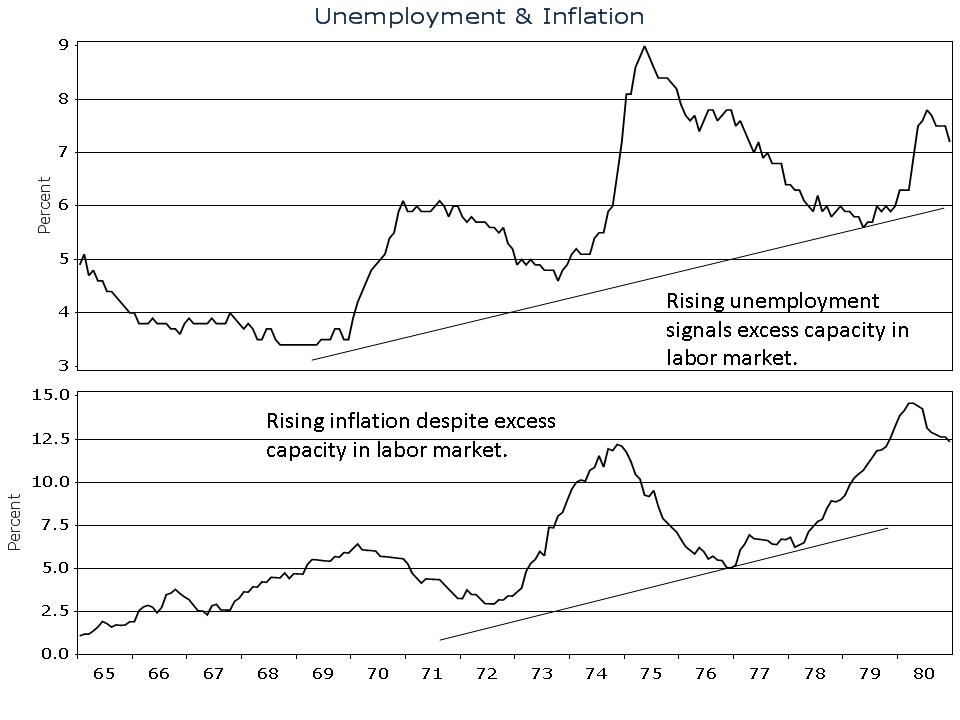

My coach demanded that we play full speed until the whistle blew because he wanted to protect us from “the blind side.” Today, many investors are leaving their portfolios exposed to a blind side from inflation. Many market participants recognize that a surging monetary base and trillion-dollar budget deficits signal a heightened risk of inflation, but the prevailing market sentiment is that inflation is not today’s problem. Excess capacity in the economy is making investors complacent about the risk of inflation. Unemployment near 10% and capacity utilization near a record low are generally deflationary, but when high-powered money explodes and the budget deficit surges, all bets are off. And the historical record shows that rising inflation and excess capacity in the economy are possible.

My charts show inflation and capacity utilization from 1965 to 1980 and unemployment and inflation from 1965 to 1980. The general trend of inflation during this 15-year period is decidedly up with some cyclical variation. The general trend in capacity utilization is decidedly down (meaning excess production capacity) with some cyclical variation, and the trend in unemployment is decidedly up (meaning excess labor capacity) with some cyclical variation. Tell me again: why can’t we have inflation when there is excess capacity in the economy?

Investors who aren’t taking the steps today to protect their portfolios from the risk of inflation are exposing their assets to a blind side. In our monthly strategy reports and at our investment management firm, we are helping investors craft portfolios that minimize the risk of rising inflation. Visit www.younginvestments.com to learn more about our investment management firm.