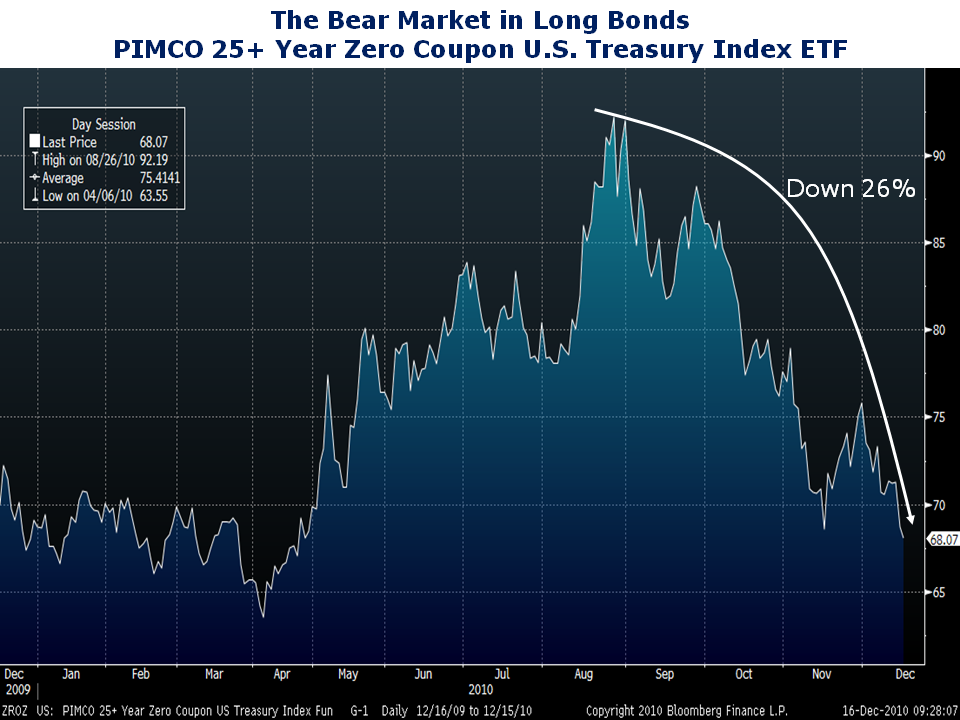

Soaring long bond yields have pushed the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF down 26% from its August high. Investors who bought the PIMCO ETF in August have now lost more than 7 years interest. Compare that to the PIMCO 1-3 Year Treasury ETF which is down only 0.65% from its 2010 high. You may not like the yields on short bonds today, but loading up on long bonds to pick up yield can quickly decimate a portfolio.