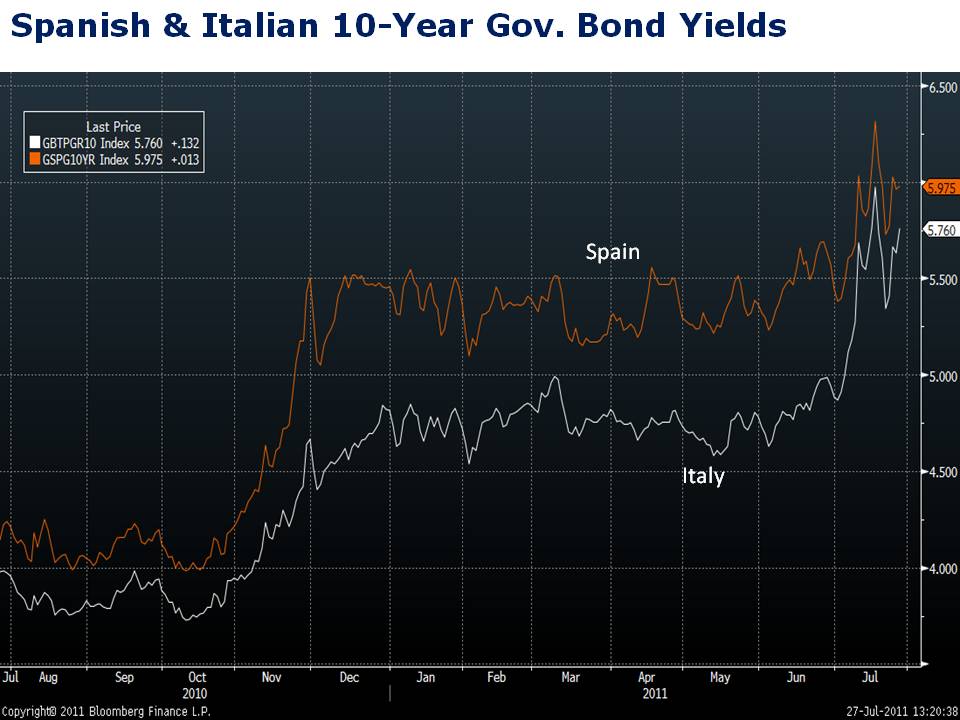

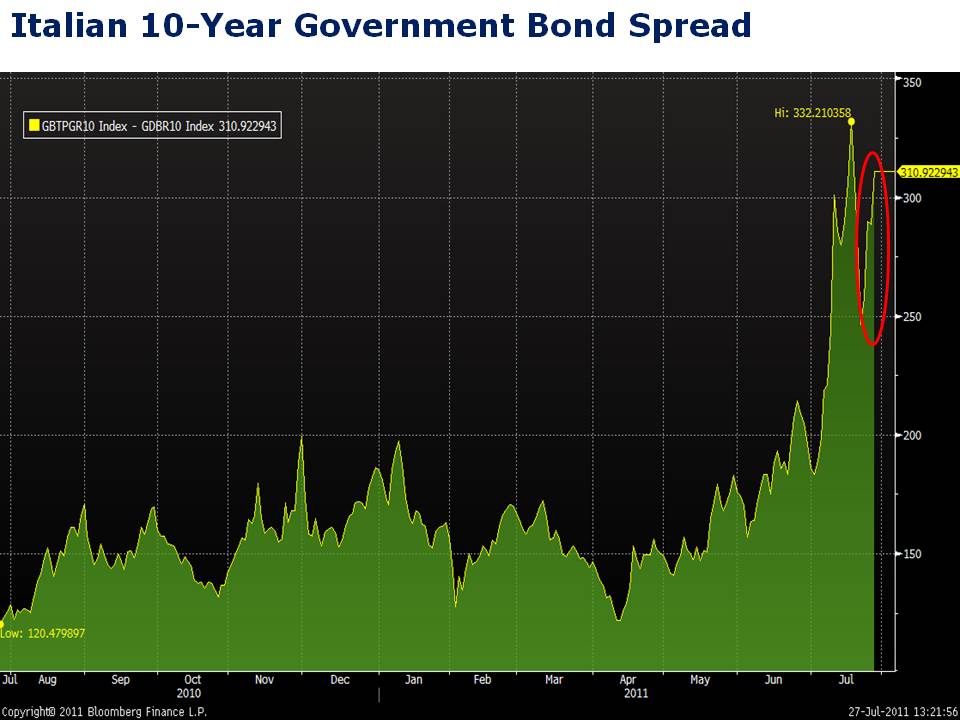

While the financial press and many market participants are focused on the debt ceiling issue in the U.S., an equally if even more alarming issue is developing in Europe. After retreating following the latest Greek bailout, Spanish and Italian government bond yields are again rising. Yields and spreads are now only a few basis points away from their pre-bailout highs. It would seem that Europe’s latest attempt at a solution to the sovereign debt crisis hasn’t convinced market participants. Bond yields near 6% in economies that are expected to grow at less than half that rate in 2011 are worrisome.

Italy is the country to watch here. Spain is small enough that it could be bailed out, but Italy is the third largest debtor in the world. It is a core euro-area economy. Keep your eye on Italian government bonds. If yields continue to rise, the euro may look a whole lot different in twelve months than it does today. That is, if it still exists.