In early 2010 at the urging of the Obama administration, Congress forced the private sector out of the student loan business. Two-and-a-half years later the Department of Education owns the majority of the student loan market, and America’s taxpayers own the accompanying risk. Josh Mitchell writes in the Wall Street Journal:

The federal government now provides the bulk of student loans. Federal loans accounted for more than 90% of all student borrowing in the 2010-2011 academic year, according to the College Board. Nonfederal loans—including those issued by states, banks and credit unions—accounted for 7%.

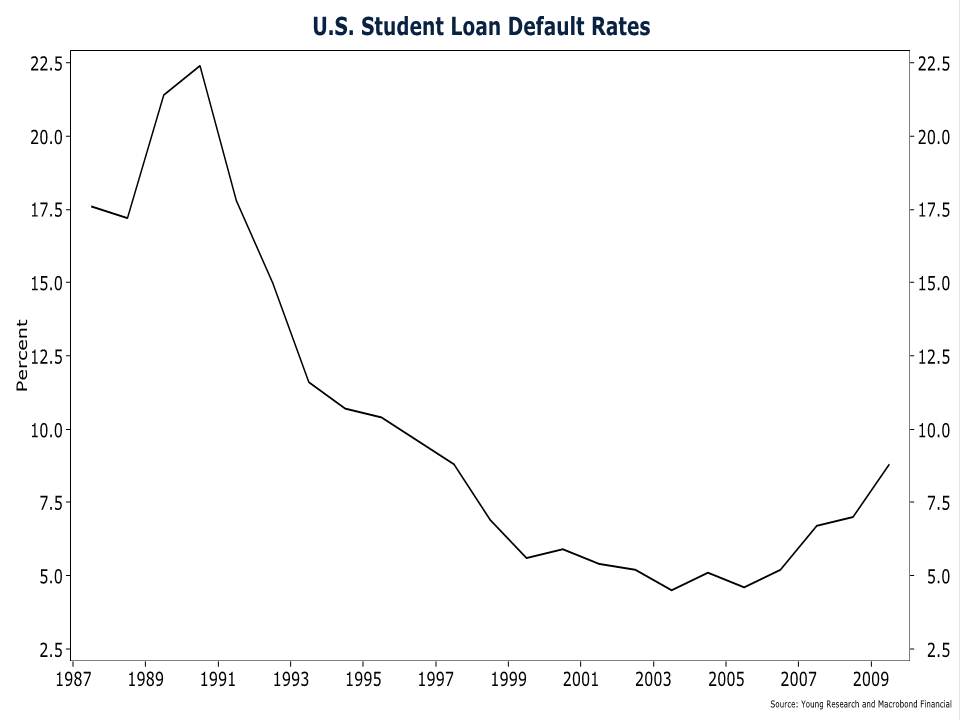

Default rates on student loans have been rising, with the most recent cohort defaulting at a rate of 8.9%, up 27% compared to the year before.

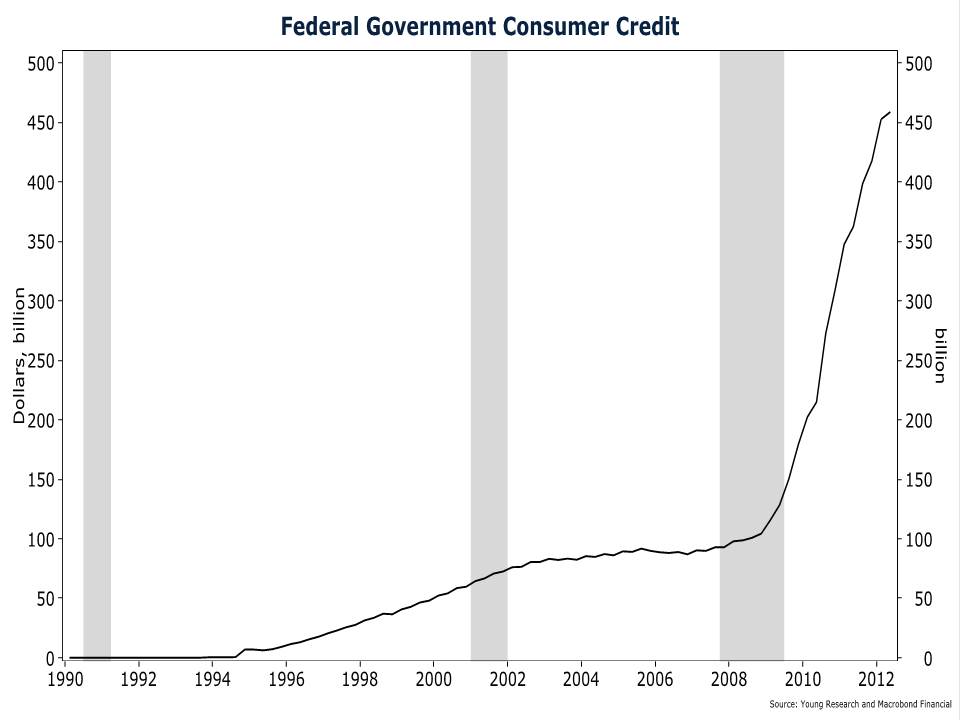

A whopping two-thirds of the growth in consumer credit in April was due to expansion of federal student loans. The government didn’t hold any consumer debt until 1993 when President Clinton signed into law the Federal Direct Student Loan Program. At the end of 2008, the government owned $104.2 billion in consumer credit. Since then, federal consumer credit assets have increased by 340% to $458.7 billion.

You can see in our second chart that default rates are rising on student loans. Taxpayers are now lending more to students even as the market becomes riskier.