Although the current economic expansion has been underwhelming for many industries, the auto market was the exception. The auto market was hit hard in the last recession, but carved out a V-shaped recovery with steady growth for much of the expansion.

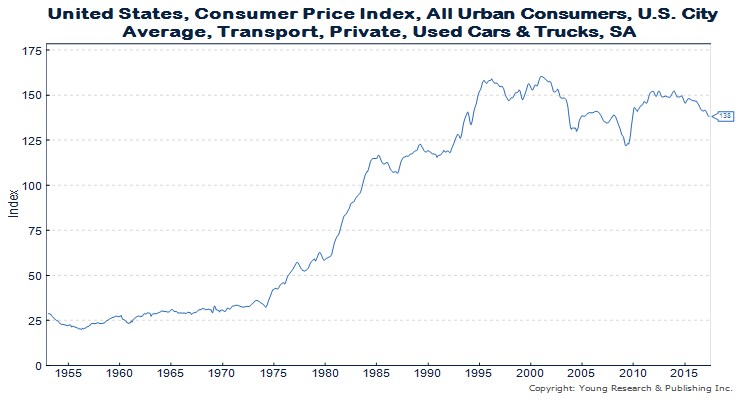

But change is now afoot. The used car market is over supplied. Used car prices are contracting and growth in new car sales has stalled.

General Motors has decided to extend its typical summer factory shutdown to clear bloated inventories. GM’s inventories are almost 44% higher than a year earlier. Slower production in the auto sector is likely to restrain GDP growth. The WSJ reports:

GM enters the summer with a glut of unsold inventory after running production lines at relatively high rates to prepare for factory downtime related to plant upgrades. WardsAuto.com estimates GM’s production increased 2.9% over the first four months of 2017, even as the broader industry pulled back.

As a result, GM’s inventory at the end of May was almost 44% higher than a year earlier. It has nearly 1 million vehicles sitting on dealer lots, WardsAuto.com estimates, representing 101 days’ worth of supply, or 23.4% of total industry stock….

A preference for trucks is only part of the industry’s passenger-car problem.

People are now returning increasing numbers of sedans to dealerships as leases expire. That has created ample supply of cheap, late-model used cars, making new cars even tougher to sell.

Tommy Brasher, a Chevy dealer in Weimar, Texas, said his Malibu inventory is “a little heavy” and business has slowed across the board in recent months.

“We just haven’t been seeing much foot traffic or internet traffic,” he said. “April was slow, May was worse and June started the same.”

Read more here.