The conventional wisdom is that bonds are a terrible investment when inflation accelerates. The theory is that rising inflation causes interest rates to rise and bond prices to plummet. The financial media has been pounding the table on this thesis for months. Check out “Stop Gobbling Up Bonds—They’re Risky!” in Fortune’s Investor’s Guide 2011. If inflation is your concern, the pundits will advise you to dump your bonds.

They advise you to load up instead on stocks, gold, and other hard assets. Gold and hard assets are certainly an inflation hedge. All investors should own at least some gold, but you can’t put your entire portfolio in gold. Gold is a volatile asset. Unless you are among the super rich, an allocation of more than 10% could lead to financial calamity.

You could buy other hard assets, such as copper, wheat, or oil. In an inflationary environment, hard assets should maintain the purchasing power of your money, but have you checked the charts on these commodities recently? Wheat has gone parabolic, copper is at an all-time high, and oil has surged. The easy money has been made.

Real estate is a hard asset that over time has acted as an inflation hedge, but in case you’ve missed the headlines, the real-estate bubble is still deflating. There is an oversupply of homes on the market or in the foreclosure pipeline that should keep a lid on prices for the foreseeable future. It is possible that in an inflationary environment home prices will lose value in real terms.

That leaves stocks. Okay, so you’ll invest some of your assets in gold and the balance in stocks. Over the long term, a portfolio of gold and stocks should at least maintain its value in real terms. But a portfolio invested exclusively in stocks and gold is not at all advisable for conservative investors and those in or nearing retirement.

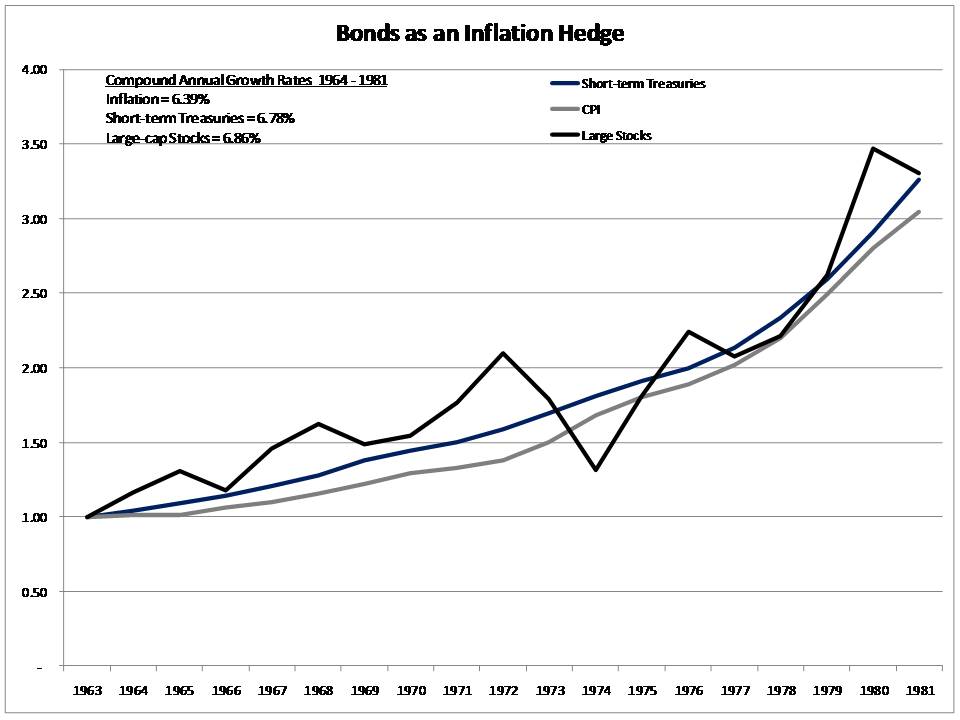

The last major inflation cycle ran from year-end 1964 to 1981. Over this 16-year period, inflation averaged 6.39%. Stocks also rose during this period. Large-cap stocks were up an average of 6.86%. That equates to a real return of 0.47% per year. But in order to earn that 0.47% return, investors had to endure three neck-snapping bear markets with peak-to-trough declines of 22%, 36%, and 48%. All for 0.47% per year. Sound like a trade-off you are willing to make?

I think not. Fortunately, you can maintain the purchasing power of your portfolio without taking excessive risk. To hedge against inflation, you want to buy bonds. But not all bonds.

If you buy long bonds, your portfolio will indeed take a thrashing when inflation and interest rates rise.

You want to buy short-term bonds. Short bonds are a low-risk inflation hedge. When you buy short-term bonds, you aren’t locking your money up for a long period of time. If you buy a one-year bond at 5% and rates rise to 7%, you will be able to invest the proceeds from your maturing 5% bond into another one-year bond yielding 7% in one year’s time. When you keep maturities short, inflation risk is minimized.

My chart below compares the growth in $1 invested in one-year Treasuries, the Consumer Price Index, and large-cap stocks from year-end 1964 to 1981. Both stocks and bonds kept pace with inflation, but bonds did it with a fraction of the volatility. If you want a low-risk inflation hedge, buy bonds and keep the maturities short.