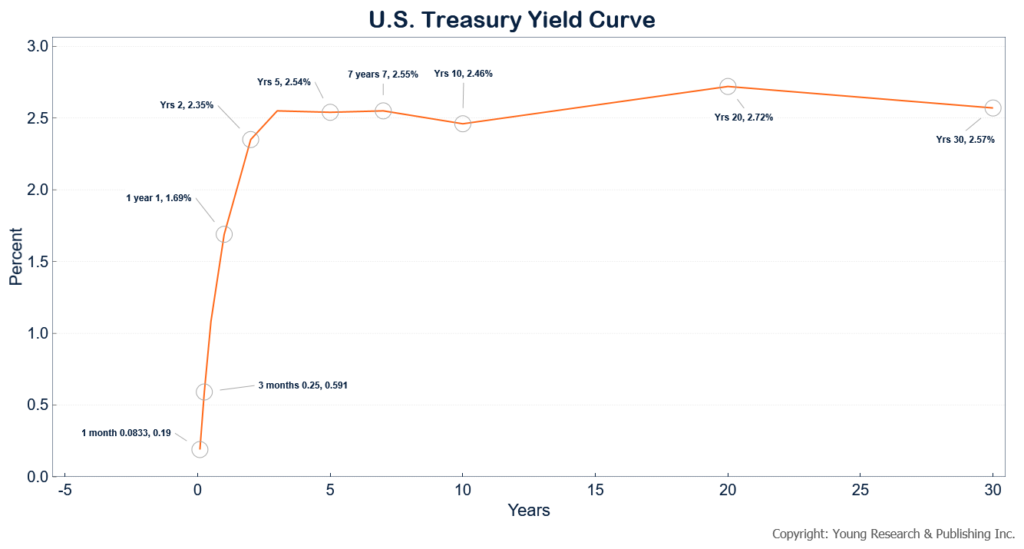

Portions of the Treasury yield curve have inverted, but the FT’s Lex service downplays the risk of the current yield picture. They write:

Wall Street is obsessing over the US yield curve these days. No wonder. An inverted US yield curve, in which short-term interest rates are higher than long-term ones, is widely seen as an ominous sign of looming recession risks.

On Monday, the yield on 30-year Treasuries fell below that on five-year ones for the first time since 2006. That comes after yields in other parts of the curve — namely the five to 10-year and three to 10-year — inverted last week.

Even the closely watched two to 10-year part of the curve is becoming dangerously flat. The moves appear to reflect fears that efforts by the US Federal Reserve to tackle inflation with aggressive rate rises could hurt economic growth or even tip the US into a recession.

But do not cue the jitters yet. While inversions in the curve have certainly preceded many previous recessions, there are technical factors to consider when talking about the current bout of yield curve inversions. Namely, quantitative easing has distorted rates.

The sheer amount of Treasuries the Fed bought to prop up the economy during the pandemic has left the long end of the yield curve — particularly the 10-year — artificially low. Analysts at Evercore reckon that if you strip away the effects of the stimulus, the 10-year yield would be about 3.60 per cent — leaving the spread between the two-year and 10-year at about 130 basic points.

That would be in line with the spreads seen in another closely followed part of the curve — the 10-year and three-month. This has actually been widening — to a five-year high of 196 bps on Friday. This would suggest the markets believe the Fed can tighten enough to keep inflation under control without causing a recession.

Other economic indicators — a low unemployment rate, brisk consumer spending — suggest the US economy remains on solid footing despite rising inflation. None of this will end Wall Street’s fixation with the yield curve. But it should be enough to temper some of the inversion fears.

Read more here.