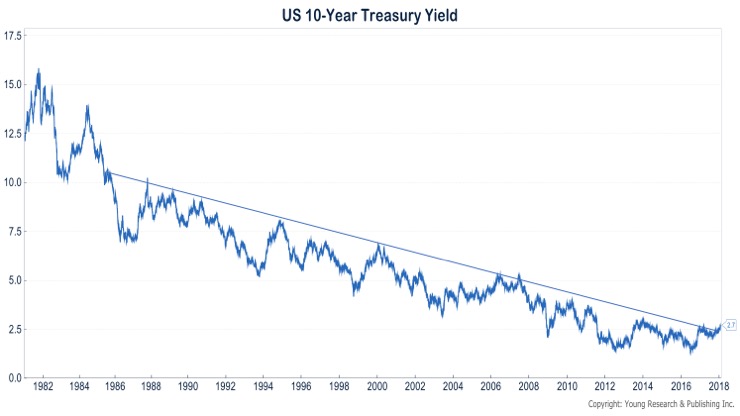

In September of 1981, 10-Year Treasury rates peaked at almost 16%. From that high, interest rates went on a three-and-a-half decade secular decline that colored every asset class in the world. Bond prices benefited from the decline in interest rates, but so did stocks, real estate, private equity, venture capital, and art among other asset classes.

In July of 2016, the multi-decade bull market in bonds ended when the 10-year Treasury rate hit 1.31%. Rates moved up following the 2016 low, but only recently have they broken above their three-decade downward sloping trendline. The breakout may be one of the most consequential in your investing lifetime.

The end of the great bond bull market signals the beginning of a new paradigm in financial markets. Bonds may be at the start of a bear market, but that isn’t the most important takeaway from the breakout in interest rates. The more important implication is that financial assets no longer have the tailwind of regularly falling long-term interest rates at their backs. Returns on a wide spectrum of assets are likely to be much lower looking forward than they have been looking backward.

Plan your personal financial and investing strategy accordingly.