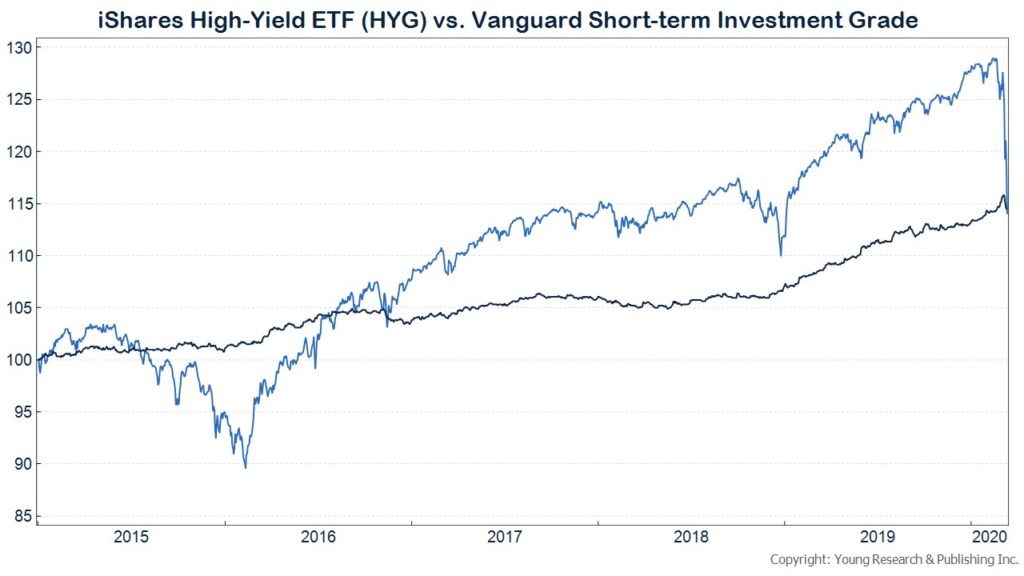

For much of the last five years, junk bonds have outpaced short-term investment-grade bonds. Ultra-low interest rates, quantitative easing, and a central bank set on rescuing investors during every episode of market turbulence emboldened investors to reach for yield in high-yield bonds.

We advised against such a strategy. Risk must always be evaluated before return.

Turns out, easy money can’t cure coronavirus. The iShares High-Yield Bond index just gave up more than 5-years worth of return advantage over the Vanguard Short-term Investment Grade fund. It only took a couple of weeks for the losses to compound.

To make matters worse, investors who reached for yield in junk bonds are watching their bond portfolios melt-down just as the stock market is plunging to new lows.

High-yield bonds have a role to play in portfolios during periods of despair and revulsion (much closer to that today), but not without an adequate margin of safety.