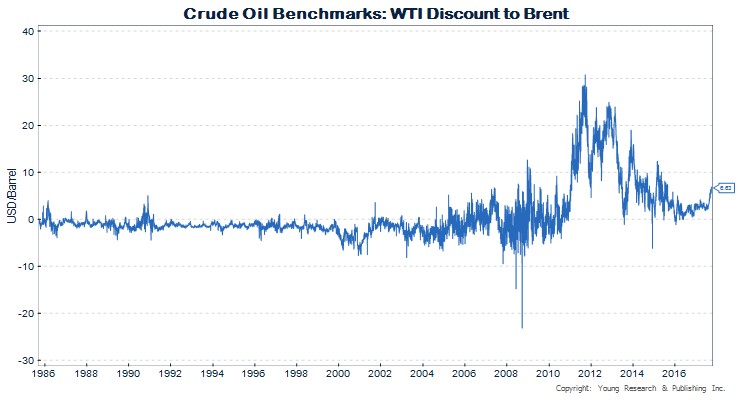

Prices for WTI crude have dropped in the aftermath of Hurricane Harvey. The Texas crude benchmark price has dropped to a $6.63 discount per barrel compared to Brent crude (See my chart of the spread’s historical width below). That spread is more than enough to make crude oil shipments out of Texas profitable. The deep spread could drive a surge in American energy exports. Alison Sider and Lynn Cook report:

A difference of at least $4 makes it attractive for a refiner in countries like China or South Korea to buy oil from shale producers in Texas and North Dakota, said R.T. Dukes, an oil expert with consulting firm Wood Mackenzie.

“Get to a $4 spread and you can take it anywhere in the world,” he said.

Take Occidental Petroleum Corp. OXY -0.22% , a major U.S. exporter and large producer in the Permian Basin of West Texas. Occidental is shipping more crude than ever as lower U.S. prices boost demand for oil from the Permian. The company recently struck new deals with customers in South Korea, India, China and countries in Southeast Asia, said Cynthia Walker, an Occidental senior vice president.

While the recent discount on West Texas Intermediate (WTI) crude, the U.S. reference price, is poised to increase American shipments, the U.S. had already become a disruptive force in global energy markets, sending oil overseas after a ban on most exports was lifted at the end of 2015. In recent years, the rise of the highly productive and nimble U.S. shale industry has pushed oil prices down world-wide. Exports have become a relief valve for U.S. drillers, who have continued to pump despite relatively low prices.

Because many big Gulf Coast refiners are largely geared to process heavy crude, like the output from Canada and South America, they have continued to import barrels, while some of the output from shale formations has started to flow abroad to refiners set up to process the light, sweet variety.

“The export window is wide open,” said Michael Wittner, global head of oil research at Société Générale.

Read more here.