Exxon Mobil will merge with Pioneer Natural Resources in an oil mega-deal that could transform the Permian shale basin. Tomi Kilgore reports for MarketWatch:

Exxon Mobil Corp. confirmed Wednesday an agreement to buy shale driller Pioneer Natural Resources Co. in an all-stock deal valued at $59.5 billion, or $64.5 billion including debt.

“Pioneer is a clear leader in the Permian with a unique asset base and people with deep industry knowledge,” said Exxon Mobil Chief Executive Darren Woods. “The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis.”

Pioneer shares rose 1.9% in premarket trading, while Exxon’s stock fell 1.3%.

Under terms of the deal, Pioneer shareholders will receive 2.3234 Exxon shares for each Pioneer share they own. The companies said that based on the Oct. 5 closing prices of $108.99 for Exxon’s stock and $214.96 for Pioneer’s stock, the deal values Pioneer shares at $253.23 each, or a 17.8% premium.

The Wall Street Journal had reported on Oct. 5 that a deal was near.

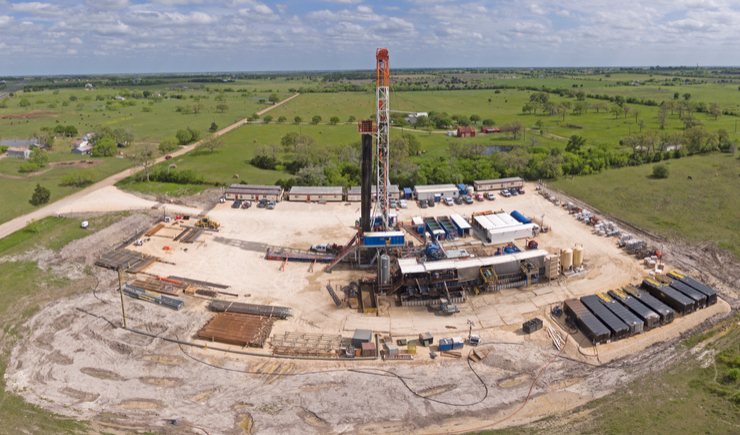

The deal combines Pioneer’s more than 85,000 net acres in the Midland Basin with Exxon’s 570,000 net acres in the Delaware and Midland Basins. Combined, the companies will have an estimated 16 billion barrels of oil equivalent in the Permian.

Read more here.