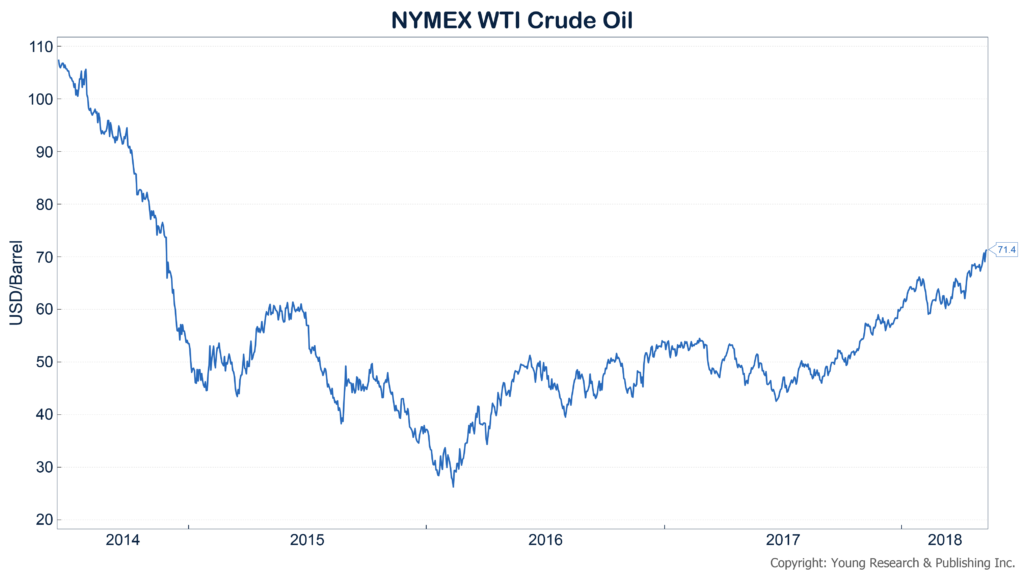

With the U.S. renewing sanctions on Iran, OPEC’s oil production curtailment program is being questioned. The sanctions are pushing oil prices higher, so OPEC must decide if it will produce more oil during the unexpected windfall, or if it will keep production stable and push prices higher for greater profits. At Reuters, Alex Lawler and Rania El Gamal report:

The Organization of the Petroleum Exporting Countries has a deal with Russia and non-OPEC producers to cut supplies that has helped erase a global glut and boosted oil prices to their highest since 2014.

Officials are considering whether a drop in Iranian exports and a decline in supply from another OPEC member, Venezuela, demands adjusting the deal that runs to the end of 2018. Ministers meet in June to review the policy.

U.S. sanctions on Iran will have a six-month period during which buyers should “wind down” oil purchases, meaning any loss of supply will not be immediately felt in the market.

“I think we have 180 days before any supply impact,” an OPEC source said when asked about any plans for action.

A second OPEC source said that, while the need to add extra supply was being considered, the safest thing for the group to do for now was to sit tight and monitor the situation.

Read more here.