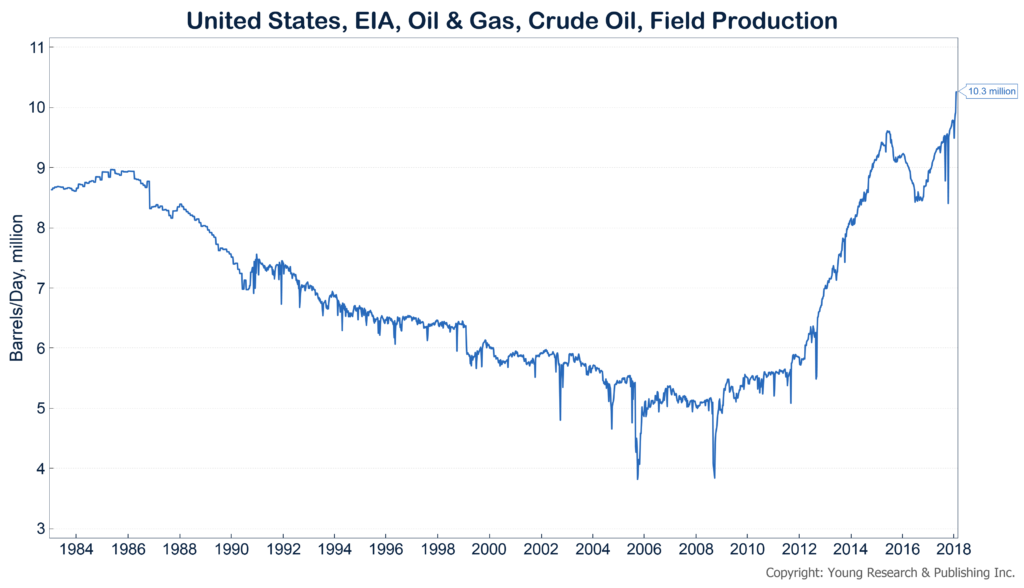

After being put on the ropes by an OPEC strategy that forced the price of oil down below $30 a barrel in 2016, U.S. shale oil producers are back, and they are producing at record rates. Christopher Alessi reports:

U.S. shale companies are churning out crude oil at a record pace that could overwhelm global demand and reverse the oil market’s fragile recovery, a top energy-market observer said Tuesday.

U.S. shale production is growing faster in 2018 than it did even during the boom years of $100 a barrel oil prices from 2011 to 2014, said the International Energy Agency in its closely watched monthly report. The difference this time: Oil prices are about 40% lower.

The situation is “reminiscent of the first wave of U.S. shale growth,” when a flood of American oil built up a global glut and sent prices crashing over four years ago, said the Paris-based IEA, which advises governments and corporations on energy trends.

Read more here.