Saudi Arabia has chosen to cut one million barrels of oil production a day in an attempt to maintain higher prices. Could this be an opening for a resurgence in U.S. shale oil production? Dmitry Zhdannikov reports for Reuters:

The U.S. has more than doubled its oil and gas production over the past 15 years, mostly as a result of the development of shale fields.

Shale production plunged during the pandemic and lenders restricted funding, but it has since recovered and US crude exports and output have hit record highs.

OPEC+’s decision to extend existing cuts by another year will likely give U.S. producers much needed longer-term price confidence and boost their capacity to borrow.

Some of Sunday’s promised cuts include adjustments to reflect actual production from some members of the group who have been unable to meet existing supply quotas.

While Russia agreed to extend its existing 0.5 million bpd curbs into 2024, Angola and Nigeria agreed to give up their unused quotas. The United Arab Emirates was allowed to boost its production quota by 0.2 million bpd to 3.2 million from 2024.

Kaneva from JPM said the net result would be the OPEC+ decision will reduce supply in 2024 by 1.1 million bpd from previous expectations and cuts could be extended into 2025.

She expects the United States to be able to accommodate that.

New technologies could also provide shale oil producers with ways to boost production. OilPrice.com’s Alex Kimani reports on Exxon’s optimism over new technologies, writing:

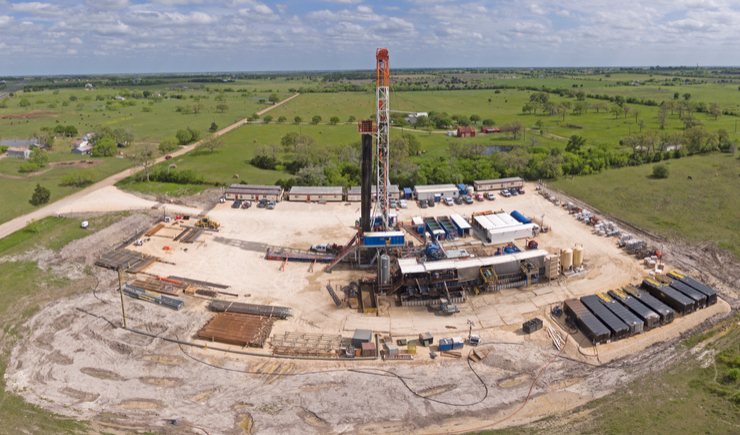

The U.S. shale revolution dramatically reshaped the world energy markets. The shale boom was one of the most impressive growth stories, from take off in 2008 to the Permian stealing the mantle from Saudi Arabia’s Ghawar as the world’s highest producing oilfield in a little over a decade. Overall, Reuters has estimated that, “U.S. petroleum production is at least 10-11 million bpd higher than it would have been without horizontal drilling and hydraulic fracturing.’’

Unfortunately, the shale patch has lately been struggling to ramp up production due to a litany of challenges including pressure from investors to boost returns, limited equipment and workers as well as a lack of capital.

But shale giant ExxonMobil Corp. (NYSE:XOM) is now betting that shale producers can double crude output from their existing wells by employing novel fracking technologies.

“There’s just a lot of oil being left in the ground. Fracking’s been around for a really long time, but the science of fracking is not well understood,” Exxon Chief Executive Officer Darren Woods said Thursday at the Bernstein Strategic Decisions conference. Woods has revealed that Exxon is currently working on two specific areas to improve fracking. First off, the company is trying to frack more precisely along the well so that more oil-soaked rock gets drained. It’s also looking for ways to keep the fracked cracks open longer so as to boost the flow of oil.

Shale Refracs

Luckily, the U.S. Shale Patch won’t have to wait for Exxon to perfect its new fracking technologies. There’s already a proven technology for oil producers to return to existing wells and give them a second, high-pressure blast to increase output for a fraction of the cost of finishing a new well: shale well refracturing.

Refracturing is an operation designed to restimulate a well after an initial period of production, and can restore well productivity to near original or even higher rates of production as well as extend the productive life of a well. Re-fracking can be something of a booster shot for producers–a quick increase in output for a fraction of the cost of developing a new well.

While refracturing has never really gone mainstream, the technique is seeing higher adoption as drilling technology improves, aging oilfields erode output, and companies try to do more with less. According to a report published in the Journal of Petroleum Technology, new research from the Eagle Ford Shale in south Texas shows that refractured wells using liners are even capable of outperforming new wells despite the latter benefiting from more modern completion designs.

JPT also estimates that North Dakota’s Bakken Shale straddles some 400 openhole wells capable of generating an excess of $2 billion if refractured. Mind you, that estimate is derived from oil prices at $60/bbl vs. this year’s average oil price of almost $90/bbl. According to Garrett Fowler, chief operating officer for ResFrac, a refrac can be up to 40% cheaper than a new well and double or triple oil flows from aging wells.

Read more here.