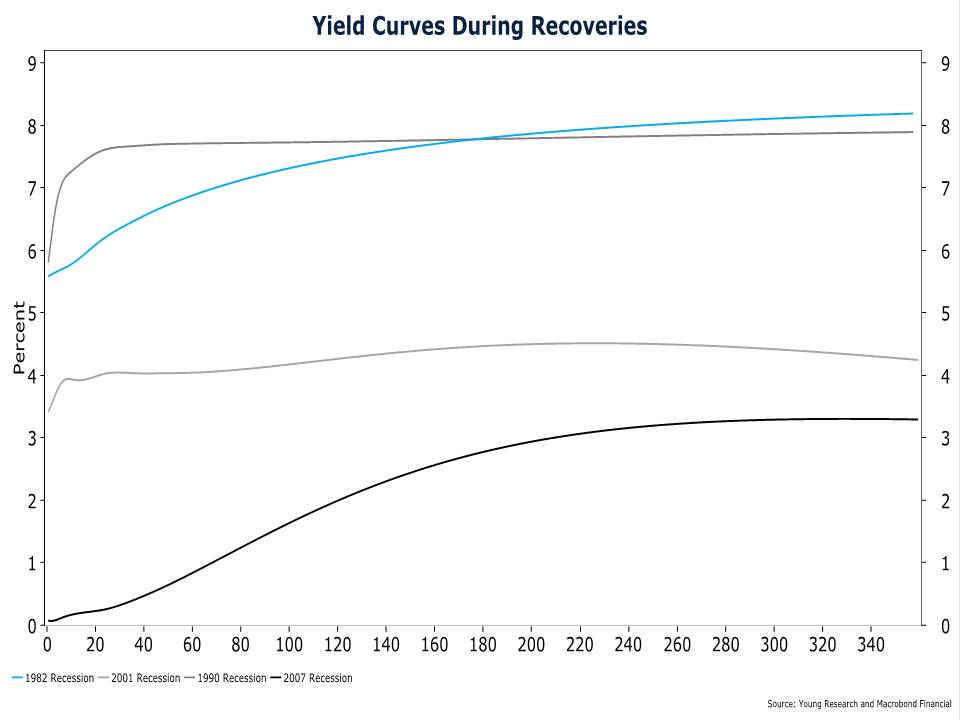

We are now over 1400 days after the official end of the Great Recession, and the Federal Reserve is still holding interest rates at historically low levels. Take a look at the chart below which includes the yield curves at the same number of days after the previous three recessions.

At this point in the recovery period after the 1982 recession, investors were earning between 5 and 6% on short treasuries, and over 8% on 30 year treasuries. A similar but slightly flatter pattern existed in the recovery following the 1990 recession.

During the recovery after the 2001 recession rates were held low for much longer, and the curve was very flat with short rates near 3.5% and 30 year rates near 4.25%. We all know how that turned out. The low rates inflated a housing bubble that blew up in 2007 brining on our next recession.

Today rates near the short end of the curve are essentially zero. Long rates are near 3.25%. So whereas investors were quickly given the opportunity to earn return again after the 1982 and 1990 recessions, since then yield has become increasingly scarce.

The Fed’s stated goal is to push investors into riskier asset classes by keeping rates on safer assets too low to be meaningful. That misguided effort is obviously working as evidenced by stock market indices near their all-time highs. Until the Fed decides to raise rates, savers and lenders will only be able to dream of higher yields on their investments.