Big changes could be coming to the gold market in the coming Indian budget. Sources have signaled that the government is likely to cut the 10% tariff on gold imports to 8% or 6%. The Reserve Bank of India has already eliminated some curbs on gold import, including a prohibition on banks selling gold on consignment. Now banks will be able to sell gold as long as they aren’t fronting the money for the inventory. Reuters quoted Prithviraj Kothari, executive director of the India Bullion & Jewellers’ Association as saying he expected as much as a 125% increase in gold imports per month.

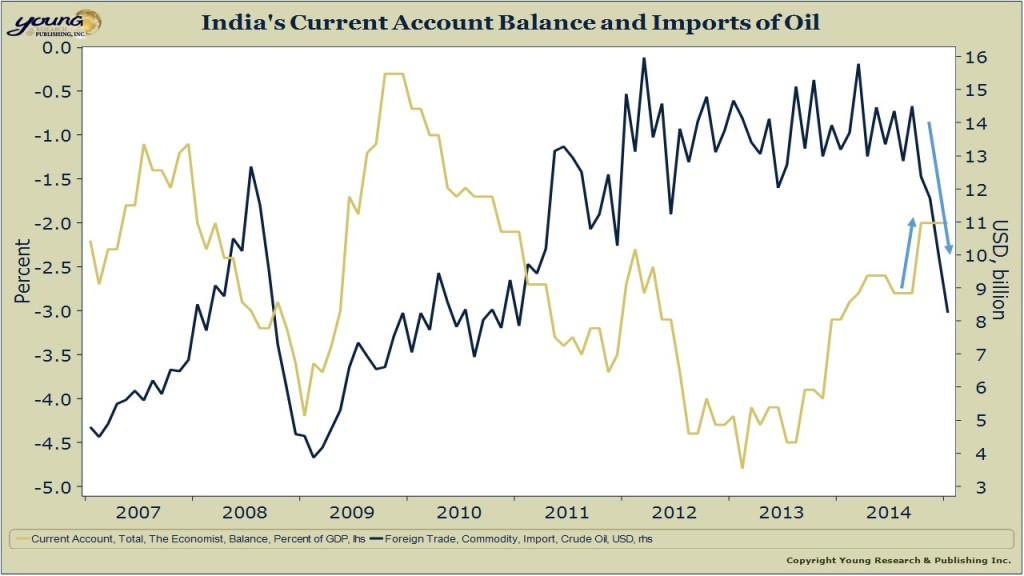

The restrictions on gold imports were originally put in place to help slow the buildup of a massive current account deficit in India. The newly elected government of Narendra Modi looks like it may be ready to reverse the previous government’s increases in the tax because India’s current account buildup has reversed in recent months thanks not only to the slower buying of gold, but to the big drop in prices for oil imports. You can see on the chart below that the reduction in the dollar value of India’s oil imports since September has coincided with a rapid reduction in India’s current account deficit from 2.8% of GDP to 2.0%.