Below is a post we did on gold mining stocks about two years ago. We repost this not to boast about how well our gold stocks have done relative to the market since then, but to impress upon our readers just how vital it is for patience to play a dominant role in your investment process. It doesn’t matter what type of investor you are or what type of investment strategy you follow, if you don’t invest with patience, you are going to be challenged to achieve long-term investment success. Patience is fundamental to the investment process we follow at Young Research and for clients of our boutique investment company.

Almost every investment strategy is going to find itself out of favor at some point during the investment cycle. It is what an investor does during these periods that separates the successful from the not so successful. Investors who abandon strategies that are temporarily out of favor with the media or that are lagging over anything less than a full market cycle are doomed to sabotage their performance.

When we wrote the post below, the market was coming off of the blow-out year of 2013. Nasdaq stocks were what we were all supposed to buy. Gold mining shares were viewed as a useless relic and treated accordingly by the market. If you owned the gold stocks we advised then, over the last two years, there is no doubt your patience has been tested. But today, after a tough couple of relative comparison years, Newmont Mining, and Agnico Eagle (the gold miners we were advising then) are ahead of both the “must-own-Nasdaq” and the broader market. Much more importantly they have provided a powerful counterbalance to many other positions in your portfolio that are falling with the broader market.

Remember your gold shares the next time you become tempted to sell what may be out of favor today (anything related to energy comes to mind).

Top Gold Mining Stocks for Long-term Profit

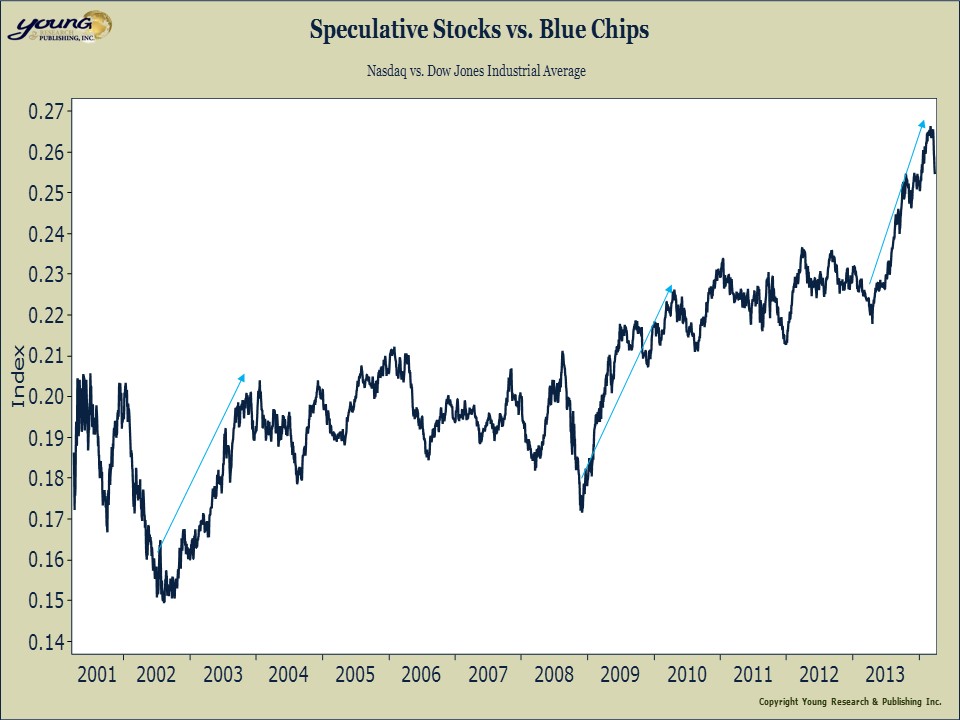

Although the stock market is basically flat YTD, there is rampant speculation bubbling under the surface. The bubble conditions in the stock market are evident in the flood of junk IPOs the investment banks are unloading on the public, the ridiculous valuations of the social networking stocks, the bidding wars for start-ups without a viable business plan, and the massive buildup in margin debt.

The speculative conditions in the market are best captured by the ratio of the NASDAQ to the blue-chip Dow Jones Industrial Average. When NASDAQ stocks are beating the blue-chips by such a large margin, you can be sure there is speculative froth in the market. Today, we are looking at one of the most speculative markets in over a decade.

Unless you are taking a reckless amount of risk, chances are the hot money crowd is leaving you in the dust. That’s fine, if temporarily unpleasant. You don’t want to chase performance in a speculation-driven market. Enduring periodic bouts of lagging performance is what enables savvy investors to generate the long-term returns that trump those of the average investor.

What is a long-term investor to do today? At Young Research, we are advising investors to craft portfolios focused on dividend payers that are out of favor.

What securities are out of favor? Anything related to precious metals is viewed as ghastly and grizzly by institutions and individuals alike. Precious metals shares have taken a savage beating, both on an absolute basis and relative to gold. The Market Vectors Gold Miners index is down over 60% from its highs in 2011 and almost 50% since year-end 2012. You would be hard pressed to find a more out of favor sector in the market.

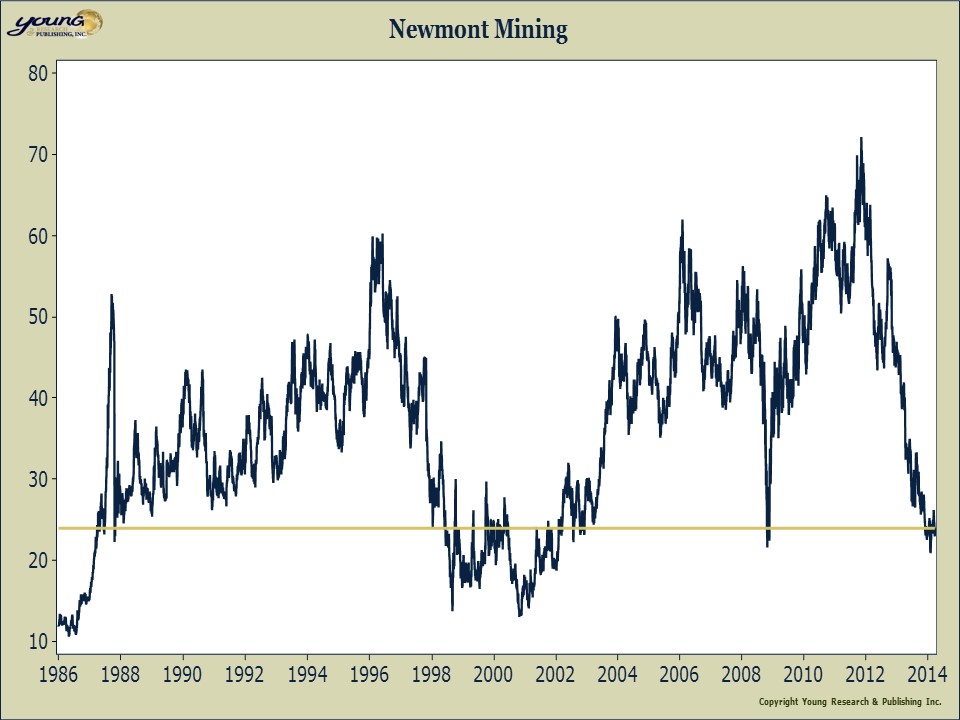

In our premium strategy reports, we have recommended a range of dividend paying precious metals shares. One of our favored gold names today is Newmont Mining.

Founded in 1921, Newmont Mining is one of the largest Gold Producers in the world. Newmont has significant assets in the United States, Australia, Peru, Indonesia, Ghana, New Zealand and Mexico. Founded in 1921 and publicly traded since 1925, Newmont is the only gold producer included in the S&P 500. Like many of the precious metals miners, Newmont is deeply out of favor with the investing public. Newmont shares are trading no higher than they were in the first quarter of 1987 when gold was trading for a third of what it changes hands for today.

Anytime you buy something as out of favor as Newmont, you should be prepared to hold, not for weeks or months, but for years. Patience is the mandate when you invest in out of favor names. You trade short-term profits for the prospect of substantial long-term gain.