If you are new to dividend investing, divided dates may still be a bit of a puzzle to you. There are many different dividend dates to remember including the declaration date, the ex-dividend date, the date of record, and the payment date. What are they?

We’ll explain all of the important dividend dates and what they mean for you.

What is the Dividend Declaration Date?

The calendar of dividend dates is actually made up of a number of different events, and the first is the declaration date, which happens weeks or months before the dividend itself is actually paid. On the declaration date, the company’s board of directors announces (it’s also known as an announcement date) a forthcoming dividend payment. Normally this information is distributed via press release and serves to give investors and their brokerages time to prepare for the dividend payment.

For most dividend paying U.S. companies, dividends are declared and paid quarterly. Foreign stocks are a different story. Dividend frequency for foreign companies depends on the country of domicile. Some foreign stocks pay dividends quarterly, others pay semi-annually, and still others pay annually.

What is the Ex-Dividend Date?

Next comes the ex-dividend date. Investors purchasing the stock before the ex-dividend date will be paid the dividend. Investors purchasing the stock on or after the ex-dividend date will not receive the dividend. The ex-date is set by the stock exchanges based on the company’s announced date of record (coming up next on our list). The ex-dividend date normally takes place a couple of business days before the date of record so any stock purchases placed the day before the ex-date have time to settle. (Trades settle three days after their initiation in general. This lag is known as T+3.)

What is the Dividend Date of Record?

On the date of record, the company paying the dividend will determine who owns its stock and how many shares they own in order to prepare payment. All stock holders who purchased shares before the ex-dividend date should be recognized and then paid accordingly.

What is the Dividend Payment Date?

The dividend payment date is the date that the dividend is deposited into your brokerage account.

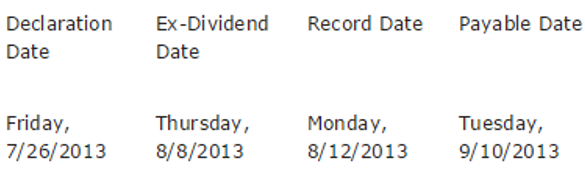

Here’s an example of how normal dividend dates might be scheduled:

Special Dividend Rules

A special dividend is an unexpected payout a company announces in addition to its regular dividend (or as a standalone return of capital to shareholders in the case of companies that don’t normally pay dividends). These dividends can be very large compared to normal quarterly or annual dividends.

In the case of those special dividends that reach or exceed 25% of the price of the security, the timing of ex-dividend dates changes. Stock exchanges set the ex-date on large special dividends one day after the pay-date. The obvious problem caused by an ex-date that occurs after a record date, is that the stock may have been sold by holders of record to new buyers after the record date but before the ex-dividend date. In those cases, the holders of record incur a “due bill.” That means that they’ll have to pay the dividend to the new owner of the security after the pay date.

The reason stock exchanges set their ex-dividend dates on large special dividends after the pay date is that once the dividend is paid, the exchange has to make a corresponding adjustment to the price of the security. Normally the amount is small and the dividend is expected so options that are based on the security have already priced these changes in. But for large special dividends, an adjustment ahead of the pay date would interfere with the proper pricing of options based on the security. Rather than re-price every option, it’s easier to simply implement the later ex-dividend date and “due bill” feature explained above.

Stock Dividends

Occasionally companies will pay their dividends in the form of stock. The process works very much like a Special Dividend in that the ex-dividend dates are set for a day after the payout. Only, in the case of a stock dividend the shareholder receives extra shares of stock, and anyone with a “due bill” will forward extra shares to the buyer, not cash.

You can find ex-dividend dates, record dates, and payment dates here.