There is increasing chatter in the financial press that the Fed is becoming concerned about the recent slowing in inflation. By the Fed’s preferred personal consumption expenditures index, inflation is running at 1.4%–down from 1.75% in 2016.

I know what you are thinking, oh the horror!

The Fed’s focus on hitting an arbitrary 2% inflation target makes little sense to most Americans. Why not target zero? Or if you are going to bother with a target, why not set a range? Does a couple of a tenths of a percentage points in inflation make any difference to anybody outside of academia?

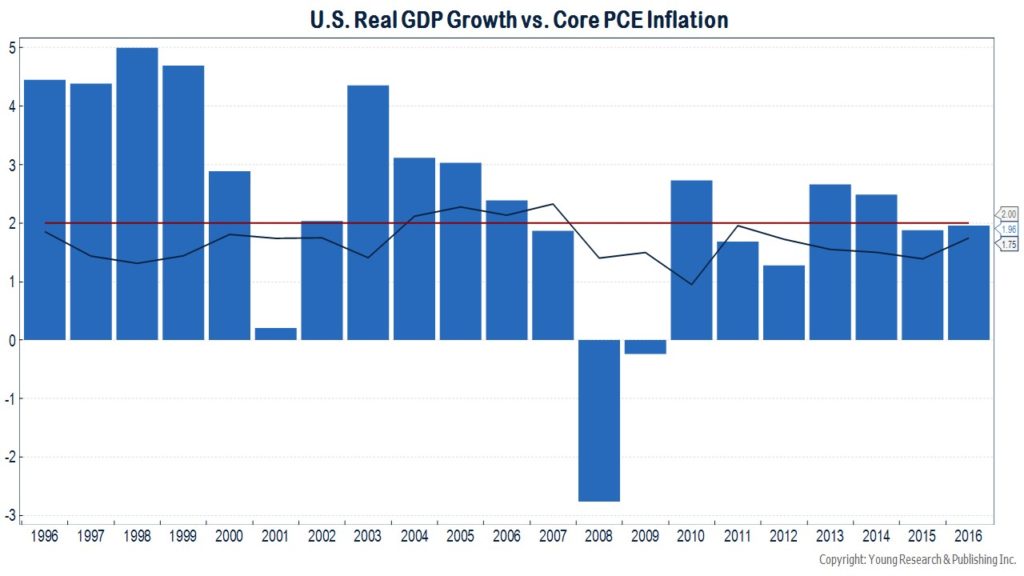

Below 2% inflation hasn’t made a lick of difference for growth. The late 1990s had some of the strongest growth in decades and not once from 1996 through 2003 did the Fed’s preferred inflation measure reach 2%. Three of the strongest years of growth during the period were 1997-1999. During that period, core PCE inflation averaged …wait for it….1.40%.

Over the last 21 years, core inflation has only met or exceeded the Fed’s 2% goal a quarter of the time.

Don’t let the professors fool you, a 1.4% core inflation rate is no reason to further delay the most belated interest rate normalization on record.