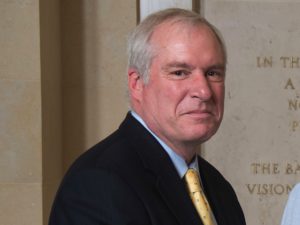

The Federal Reserve Bank of Boston’s President, Eric Rosengren, has criticized the Fed’s low interest rate policy. Rosengren believes the policy has created an unstable buildup in risk. The Wall Street Journal’s Michael S. Derby reports:

Mr. Rosengren opposed the Fed’s move in 2019 to lower interest rates, and he said Thursday the effects of those low rates on risk appetite are playing out now. The Fed lowered rates last year in large part from a realization that, as strong as the job market was then, it wasn’t driving up inflation at a time when the central bank was in fact struggling to get inflation to its 2% goal.

That reappraisal of the economy’s inflation dynamics was a key driver in the Fed’s overhaul of its policy-making regime to formally allow inflation to overshoot the 2% target to compensate for periods where it fell short.

Mr. Rosengren pointed to commercial real estate and other sectors with debt levels as areas where risk-taking may have stored up problems before the downturn.

“The increased risk buildup, such as the reaching-for-yield behavior in commercial real estate or increased corporate leverage, make economic downturns including this one more severe,” he said. “These are issues that I and others spoke about quite extensively in the years before the pandemic hit.”

Mr. Rosengren said the U.S. regulatory system struggles to rein in risk-taking, and that means, and that means officials will need to carefully consider the unintended consequences of their actions.

“If we expect to remain in a low-interest-rate environment for a protracted period of time, we need to take more precautions against financial stability risks for when the next economic shock hits,” he said.

Read more here.