Lately the market has been reacting to economic data releases with the outlook that good is good, but bad is better. Bad news has been rewarded by investors pushing the market to its highest valuations since before the recent recession. This reaction is predicated on the hints of future monetary stimulus from Federal Reserve officials, and new measures recently outlined by the ECB.

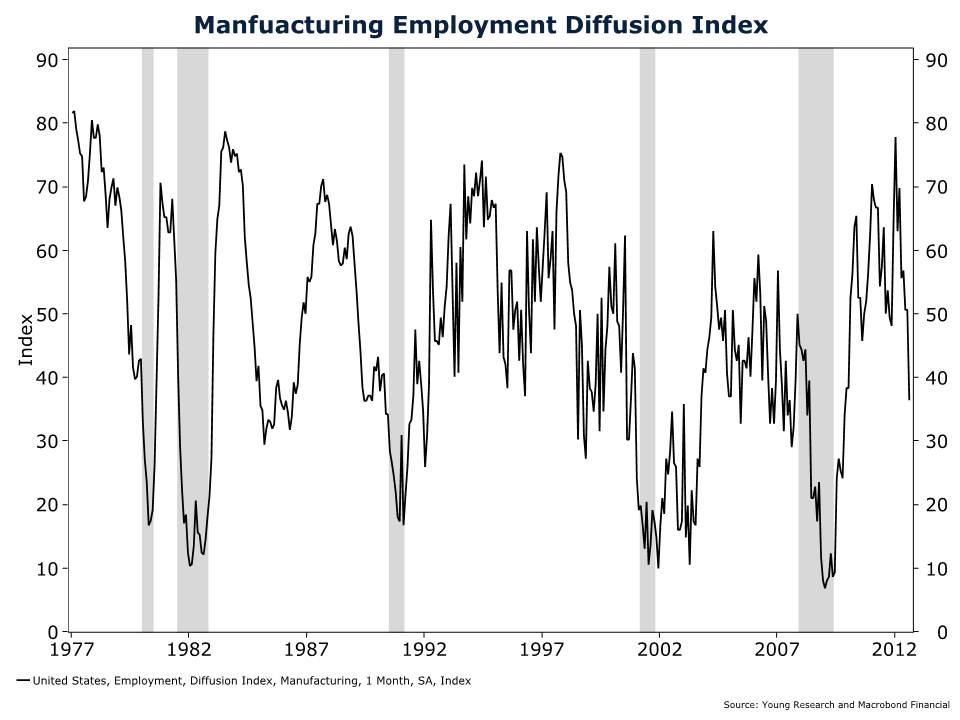

This week generated much negative economic data, including a major fall in the manufacturing employment diffusion index from the BLS. The index fell to 36.4, signaling that the majority of manufacturing companies are decreasing employment. You can see in the chart below that nearly every time the index has fallen so low, the economy has tipped into recession. Manufacturing employment is a leading indicator of total employment. If manufacturers are cutting jobs, it could signal future harm to the broader labor market.

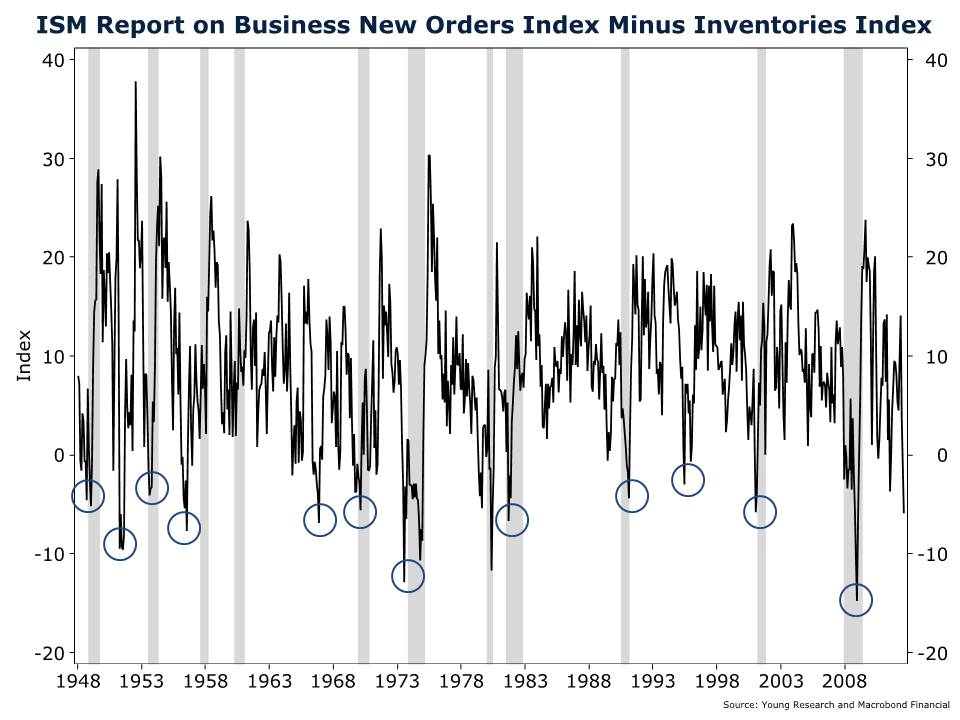

Another signal of slowing economic momentum is the relationship between new orders for manufactured goods and inventories of those goods as measured by the ISM Manufacturing Report on Business. You can see this relationship on the chart below. The chart falls when growth in inventories outpaces growth in new orders. When manufacturers build up excess inventories for which there is little demand, manufacturers are likely to cut back on new production until inventories are balanced.

Weekly initial claims for jobless benefits remain above 350,000, signaling no imminent rebound in employment, and non-farm payrolls grew by an anemic 96,000 in August. That’s not enough new jobs to keep up with new entrants into the workforce. In the face of building evidence that an economic contraction is on the horizon, the value of the S&P 500 index increased by over 2% yesterday, and is up again today.

What is driving the market toward ever higher valuations? Yesterday, it was pronouncements of an unlimited bond buying program by the ECB and today the dismal employment report seems to have cemented Wall Street’s expectation that the FOMC will announce more stimulus next week. To sum up using Wall Street’s stimulus-driven logic, a good economy is good for stocks, but a bad economy is better.