If you are retired or soon to be retired, you know firsthand how the stress of managing money rises as retirement becomes a reality. Time, once your closest ally is now a nagging foe. The security blanket of steady wage income to get you through down markets is gone. Your primary source of income in retirement is your portfolio. If you suffer a catastrophic portfolio loss, you don’t just lose money, you lose your livelihood.

The prospect of suffering a catastrophic loss can be nerve-racking. Every stock market correction is met with fear and angst. Is this the big one? Should I pull my money out of the market? The risk of catastrophic loss leads many to make emotionally charged investment decisions that sabotage performance.

How can you minimize the stress of managing money in retirement and avoid catastrophic portfolio losses? First and foremost, craft a balanced portfolio. Even at today’s low yields, including bonds in your portfolio helps counterbalance stock market declines.

In your stock portfolio, you can minimize the risk of catastrophic loss by investing in the right kind of stocks. What stocks are the right stocks?

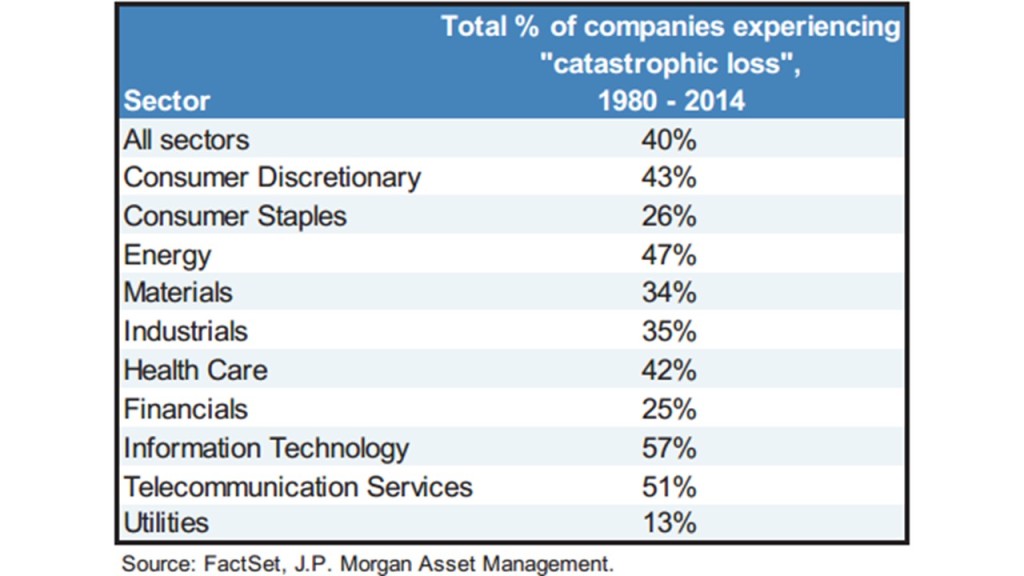

The table below (h/t Michael Batnick) from J.P. Morgan Asset Management shows the total percentage of Russell 3,000 companies in the 10 broad sectors of the market that have experienced a catastrophic loss. A catastrophic loss is defined as a 70% decline from peak value with minimal recovery.

Over the last 34 years, 40% of Russell 3000 stocks have experienced a catastrophic loss. That’s a humbling statistic. If you own 10 stocks, you can count on four cratering to a fraction of their former value.

The tech sector tops the list of losers. Nearly six out of ten technology stocks suffered a catastrophic loss. At Young Research, we have long avoided technology stocks for this very reason. Today’s winners can become tomorrow’s goats without advanced warning. Google and Facebook may look impervious to competition today, but so did Microsoft and AOL 15 years ago.

What are the sectors with the lowest percentage of catastrophic losses? Utilities, consumer staples, and financials. Financials seem to be the odd man out, but that may be due more to the regular monetary and fiscal bailouts the industry receives than anything structural. Utilities and consumer staples have low rates of catastrophic loss for structural reasons. Utilities have high barriers to entry and monopoly status while many consumer staples companies have durable competitive advantages in the form of brand value.

If you want to keep the stress of managing money in retirement to a minimum and avoid catastrophic portfolio losses, start with a balanced portfolio and focus your equity investing in the utilities and consumer staples sectors.