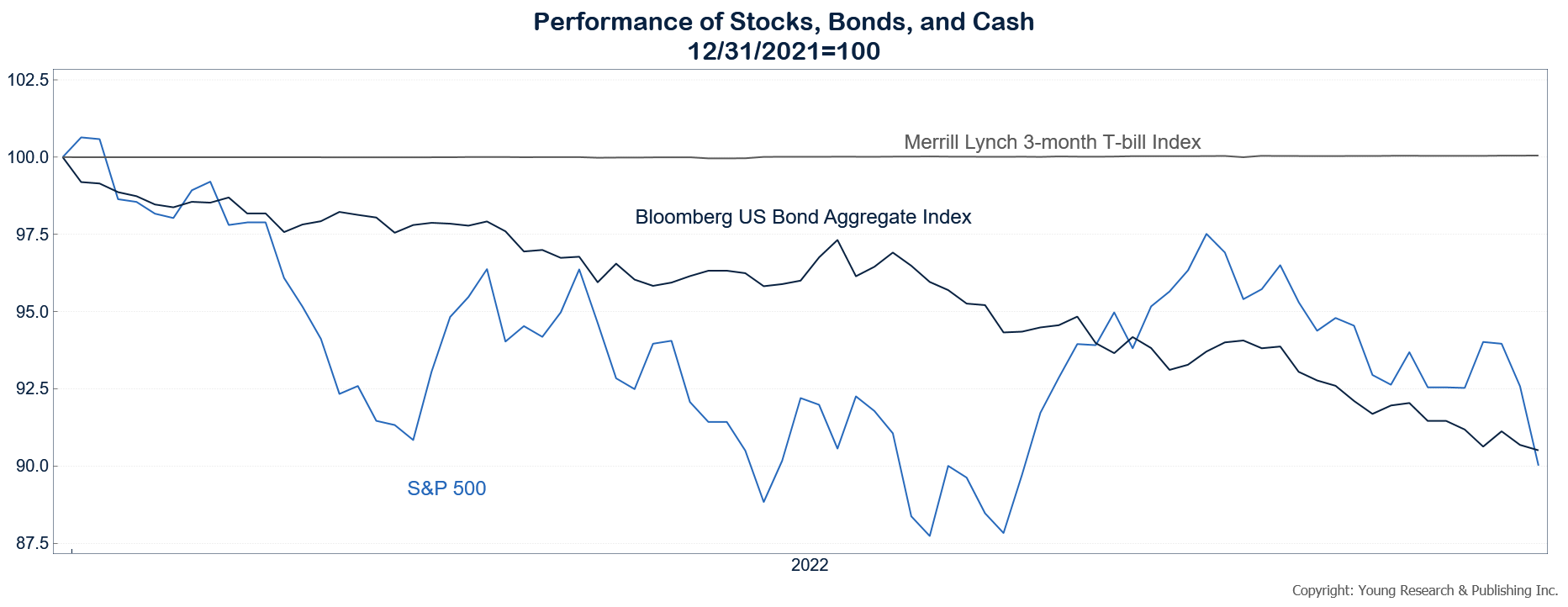

The Wall Street Journal reports that soaring interest rates and volatile equity markets are causing investors to reassess the value of cash. The chart below shows the YTD performance of the three major asset classes, stocks, bonds, and cash. Cash is measured by the performance of 3-month T-bills. Cash, with a 0.05% return, is the best performing major asset class YTD.

The WSJ has more on Wall Street’s newfound love of cash.

Rick Rieder, managing director at BlackRock Inc., said the world’s largest asset manager is increasing cash holdings by more than 50% in many portfolios to a weighting that is “much, much higher” than it had been in years past. With central banks battling inflation by raising interest rates across the world, he expects stock prices to remain volatile for the next two to six months.

“For now, one of the most attractive things you can do is have patience, and if you can get paid to have patience that’s a pretty good place to be,” Mr. Rieder said.

Prime money-market funds’ holdings in the Americas rose from just under $146 billion in February to $193 billion in March, their highest levels of the year, according to data from the Investment Company Institute. Many expect such holdings to keep rising as rates on money markets, short-term bonds and other cash-like investments climb with interest-rates set by the Federal Reserve.