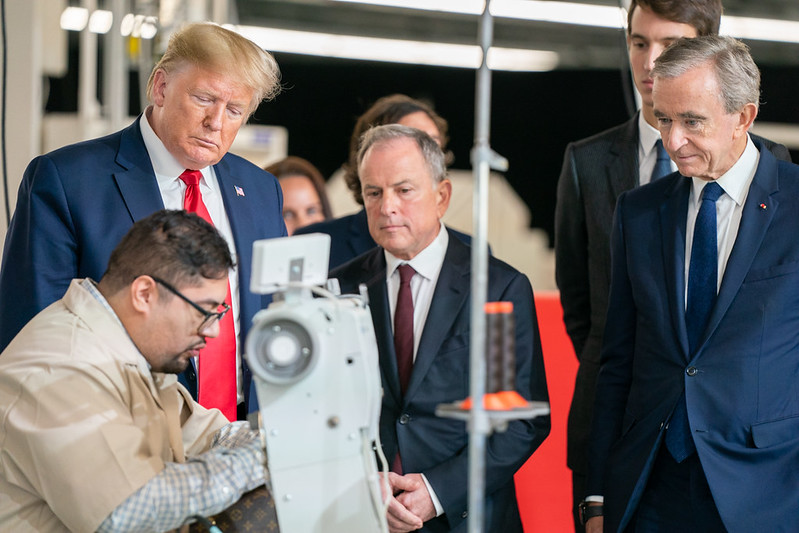

President Donald J. Trump visits and speaks with workers, as he is joined by Bernard Arnault, CEO of LVMH Moet Hennessy; Carlos Sousa the general manager of Louis Vuitton Manufacturing USA, and Advisor to the President Ivanka Trump, during a tour Thursday, October 17, 2019, at the Louis Vuitton Workshop- Rochambeau in Alvarado, Texas. (Official White House Photo by Shealah Craighead)

A rally in sales of luxury goods has put the world’s largest luxury house, LVMH, among the top 10 largest companies, with a market capitalization of $486 billion. Julien Ponthus reports for Bloomberg:

LVMH, Europe’s largest company by market value, has now made it to the world’s top 10.

A first-quarter sales beat sparked a 5% increase in the share price Thursday, giving the luxury powerhouse a 29% rally for the year. That, along with a gain in the euro against the dollar, lifted LVMH’s market capitalization to $486 billion, briefly ranking it as the world’s 10th-biggest company. Should it reach $500 billion, it would become the first European company to achieve that milestone.

“This illustrates the rise of wealthy people across the world, of a polarized society,” said Gilles Guibout, head of European equity strategies at AXA Investment Managers. “The luxury sector is therefore experiencing strong growth.”

For a growing crowd of investors, LVMH and its French luxury rivals are to the European stock market what Big Tech has been to the US: Dominant businesses whose growth holds up even as the economy waxes and wanes. Shares of LVMH and Hermes International have on average returned more than 20% annually the past decade and Kering has returned 16%. The Stoxx Europe 600 Index lags far behind at 8.3% annually.

“We have always invested in tech and in luxury, but the advantage of luxury on tech is that, while there are risks, disruption and obsolescence are lower,” said Guibout.

The robust sales of Louis Vuitton handbags and Moet Chandon champagne that have lifted LVMH’s share price also have bolstered the wealth of its founder, Bernard Arnault. He’s the world’s richest person, with a $198 billion fortune, according to the Bloomberg Billionaires Index.

Read more here.