For the last three years a revolution in real estate has been growing in America’s heartland. Since 2010 prices of agricultural land have climbed significantly. What’s behind the boom and do prices have further to climb from here? Or are they about to take a turn into negative territory?

Last year was the third fastest increase in agricultural land values since the late 1970s. The Federal Reserve Bank of Chicago found that in the Seventh Federal Reserve District, prices of good farmland were up 16%. The Seventh district takes in America’s breadbasket zone of Iowa, Wisconsin, Michigan, Indiana and Illinois. Over 2012 Iowa, America’s farming powerhouse, saw the largest increase with land values climbing by 20%.

The most surprising part of the climb was that it occurred during the worst drought since 1988. The drought took a toll on farm production, with yields of corn down 25% and yields of soybeans down 9.4%. But in the meantime prices for corn and soybeans increased by 10.9% and 11.4% in the same time period.

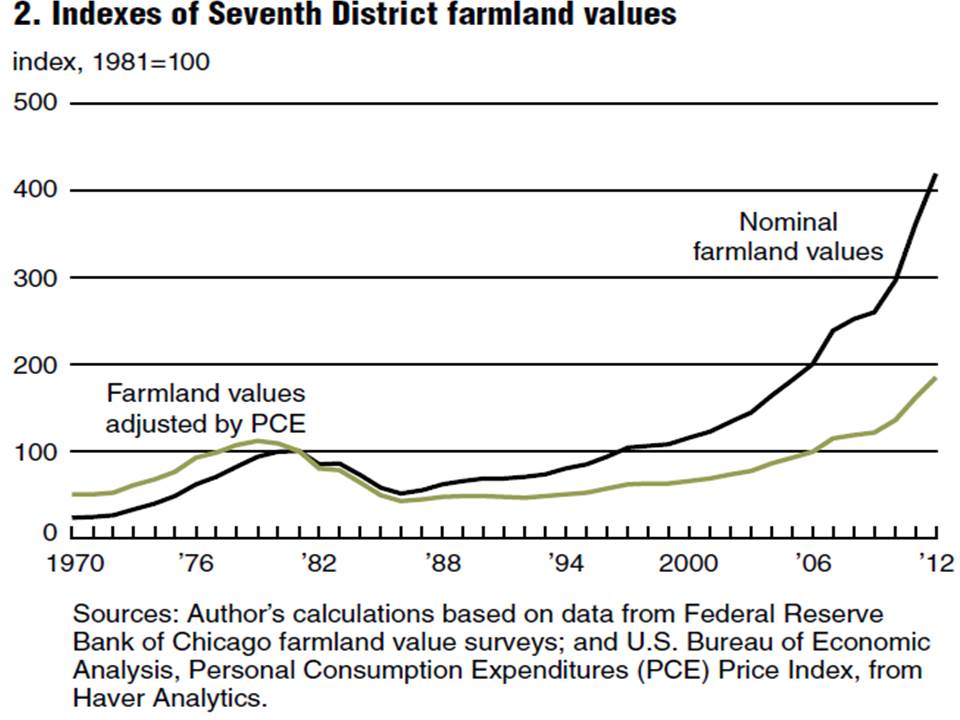

In the chart below you can see the rise in values for Midwestern farmlands. Nominal values are already parabolic, and inflation adjusted values are close behind at nearly twice as high as those in 1981. Perhaps the most telling indication about the value of farmland investments is that banks have begun restricting lending into agriculture.

As the bankers can see, and you likely can too, prices seem to be increasing faster than they normally do. With much of the nation’s farmland being diverted to producing corn based ethanol, the corn crop is artificially tight. Given a big push by legislators in the face of a food crisis, those artificial supports could be eliminated tomorrow. People will likely give up driving before they give up eating. The takeaway is to do some due diligence before investing your fortune in farmland.