For investors with a concentrated U.S. growth stock focus, the third quarter continued what has been a solid year. For veteran investors who recognize the peril of such a strategy and instead choose to take a balanced, value-conscious approach, the third quarter added modestly to what has been an OK year.

Fixed Income Markets

Fixed income markets have been a drag on balanced portfolios YTD. The Bloomberg Barclay’s U.S. Aggregate Index was flat in the third quarter and is down 1.6% YTD. We view the modest losses in U.S. bonds as a blessing in disguise. Bonds are down YTD because interest rates have risen, but today’s higher interest rates, likely mean higher fixed income returns tomorrow. While interest rates are still low by historical standards, the nightmare of zero percent interest rates has now ended. And investors who focused on short-to-intermediate-term bonds may even have positive YTD returns despite rising interest rates.

U.S. Stocks

In equity markets, the dominance of U.S. growth stocks is evident. Both large and small capitalization growth stocks are outperforming value stocks by a meaningful margin. The solid performance of growth shares is showing up in the S&P 500 whose top holdings are increasingly concentrated in FAANG stocks.

Growth’s outperformance is also apparent across S&P 500 sectors. Technology and consumer discretionary stocks are 2018’s biggest winners. And after a strong third quarter, healthcare stocks are a close third. All three sectors have a higher concentration of growth stocks than the dividend heavy consumer staples, telecom, energy, utilities, and real estate sectors.

Foreign Stocks

Global stock market indices are up YTD, but that return is being driven entirely by U.S. stocks. The MSCI All-Country World Index, Net is up 3.83% in 2018, but excluding U.S. stocks it is down 3.1%. Emerging markets have had an especially poor year, but developed foreign stock markets are also in the red.

Seasoned investors of course recognize the folly in putting too much emphasis on quarterly, YTD, or even 3-year performance numbers. It is vital to recognize that markets move in cycles. That includes growth vs. value, stocks vs. bonds, and foreign vs. domestic, among other cycles.

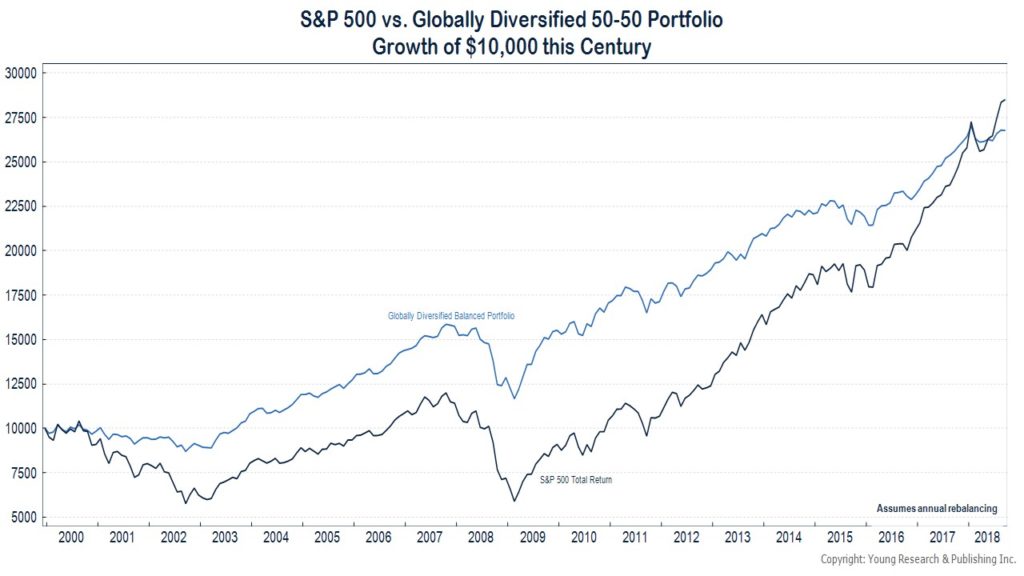

The long-term is where the savvy investor places his focus. Over the long-run, a globally diversified portfolio of stocks and bonds has reduced risk and generated solid returns.

This century, a 50-50 portfolio comprised of global stocks as measured by the MSCI All-Country World Index and Bonds as measured by the Bloomberg Barclay’s U.S. Aggregate index has turned $10,000 into $26,700. An investor would have earned about $1,600 more by investing in the S&P 500, but he would have had to endure two 50% plus bear markets and almost double the volatility of the balanced portfolio without selling a single share. In annualized terms, the percentage difference between the all domestic stock portfolio and the globally diversified 50-50 portfolio is only 0.30%.

We continue to favor a globally diversified balanced approach and advise you to consider the same approach.