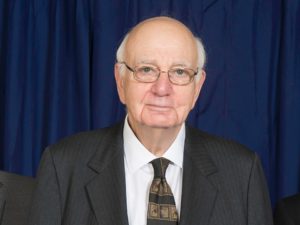

Former Fed Chairman Paul Volcker has passed away at 92. Volcker is best known for his efforts to tame the runaway inflation of the 70s and 80s. Bloomberg’s Binyamin Applebaum and Robert D. Hershey Jr. write of Volcker’s career:

Paul A. Volcker, who helped shape American economic policy for more than six decades, most notably by leading the Federal Reserve’s brute-force campaign to

subdue inflation in the late 1970s and early ’80s, died on Sunday in New York. He was 92.The death was confirmed by Janice Zima, his daughter.

Mr. Volcker, a towering, taciturn and somewhat rumpled figure, arrived in Washington as America’s postwar economic hegemony was beginning to crumble. He would devote his professional life to wrestling with the consequences.

As a Treasury Department official under Presidents John F. Kennedy, Lyndon B. Johnson and Richard M. Nixon, Mr. Volcker waged a long, losing struggle to preserve the postwar international monetary system established by the Bretton Woods agreement.

As a senior Federal Reserve official from 1975 to 1987, in addition to battling inflation, he sought to limit the easing of financial regulation and warned that the rapid growth of the federal debt threatened the nation’s economic health.