Senator Carl Levin, Chairman of the Senate Permanent Subcommittee on Investigations, invited Apple CEO Tim Cook up to Capitol Hill to testify on what the senator called Apple’s “Holy Grail of tax avoidance.”

So what is Apple guilty of that required special testimony before a Senate subcommittee? Apparently the company used perfectly legal means to avoid paying the United States’ corporate tax rate—the highest among OECD members.

[expand title=”Click here to read more.”]

Rather than wasting taxpayer dollars on fishing expeditions targeting one of America’s most successful companies, Congress should spend time reforming the corporate tax code in order to make it more appealing for businesses to run their operations here and to pay their taxes here.

Cook expressed his desire to see a corporate tax rate in the United States in the mid-20 percent range, with repatriated earnings being taxed in the single digits. This would make the American rate much closer to the average among OECD competitors. The President has expressed interest in setting the rate near those levels, along with many in both the Democrat and Republican parties.

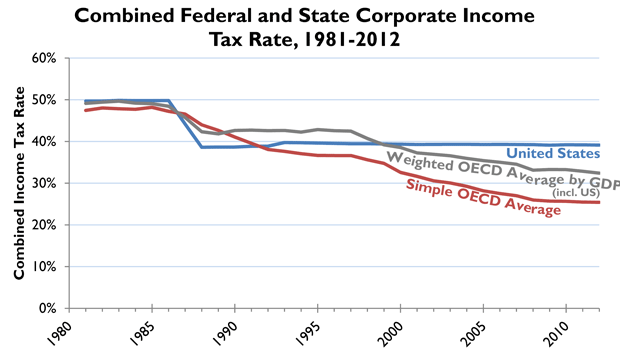

Since 1988, American corporate tax rates have increased slightly, while our main competitors have reduced their rates considerably. As you can see on the chart below, the simple average of OECD rates has fallen to the mid-20 percent range.

If companies are just going to avoid it, there isn’t much point in having the world’s highest corporate tax rate. Lowering the rate could actually increase revenue because companies currently filing using complicated processes to take advantage of lower rates overseas may abandon those locales and file here in the U.S. It would also be a powerful tailwind for smaller companies that create the most jobs in America by helping them level the playing field with their larger competitors. And for shareholders in multi-nationals, lower corporate tax rates may encourage publicly traded companies to increase dividend payouts.

[/expand]