The bull market in stocks turned 8 years old last week. This is the second longest bull market in stock market history. The longest was the bull market in the S&P 500 that ended in March of 2000 at the height of the dotcom blow-off. We all know what happened when that bull market ended. It doesn’t offer much encouragement for what’s to come when this bull market ends.

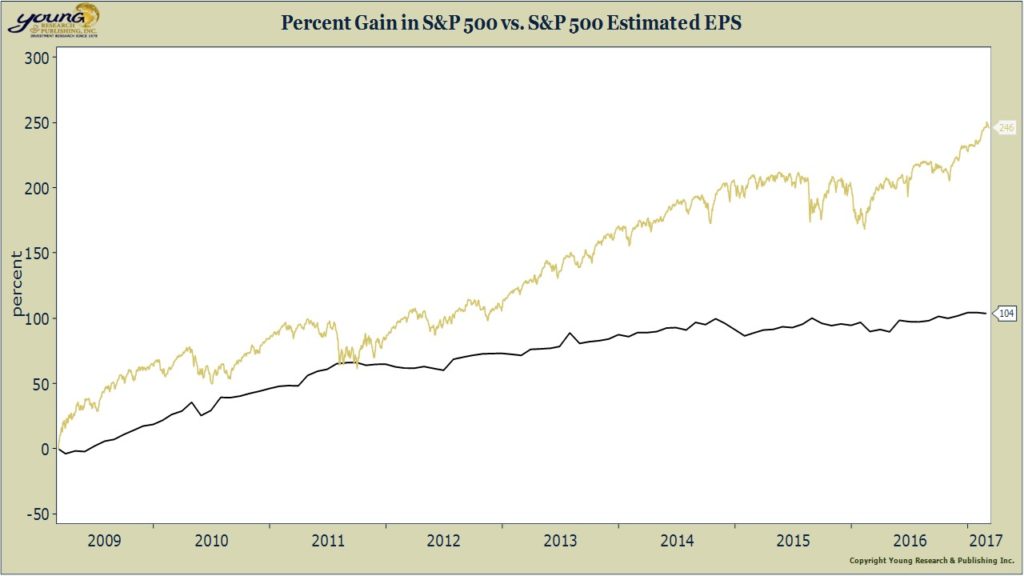

Nor is it encouraging that since the March 2009 lows, the S&P 500 has increased by nearly 250%, but earnings have only doubled. The other 150% gain in prices is purely a function of investors’ willingness to pay an ever increasing price for the same dollar of earnings. Eight years of zero percent interest rates apparently has a powerful effect on investors’ perception of value.

As Jim Grant of Grant’s Interest Rate Observer recently put it, “Grateful investors may address a note of thanks to the Federal Reserve Board, 20th St. and Constitution Ave N.W. Washington, D.C. 20551.”