Today stocks hit new all-time highs on the S&P 500. Happy days, right? Not so fast. Here’s what’s scary about the stock market’s recent climb to new highs and how it could all fall apart.

[expand title=”Click here to read more.”]

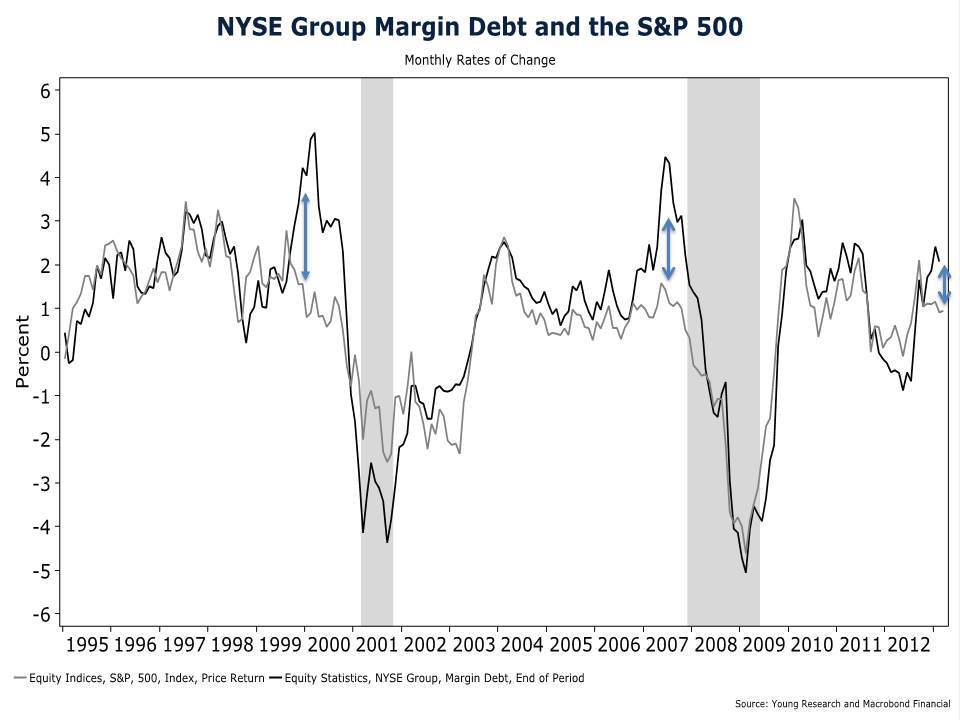

Take a look at the chart below. On it you’ll see the monthly growth rates for stock prices (the S&P 500 index) and margin debt (on the NYSE). Normally the two track one another pretty closely. But look what happened just before the last two recessions. Margin debt growth spiked, while price growth for stocks decelerated.

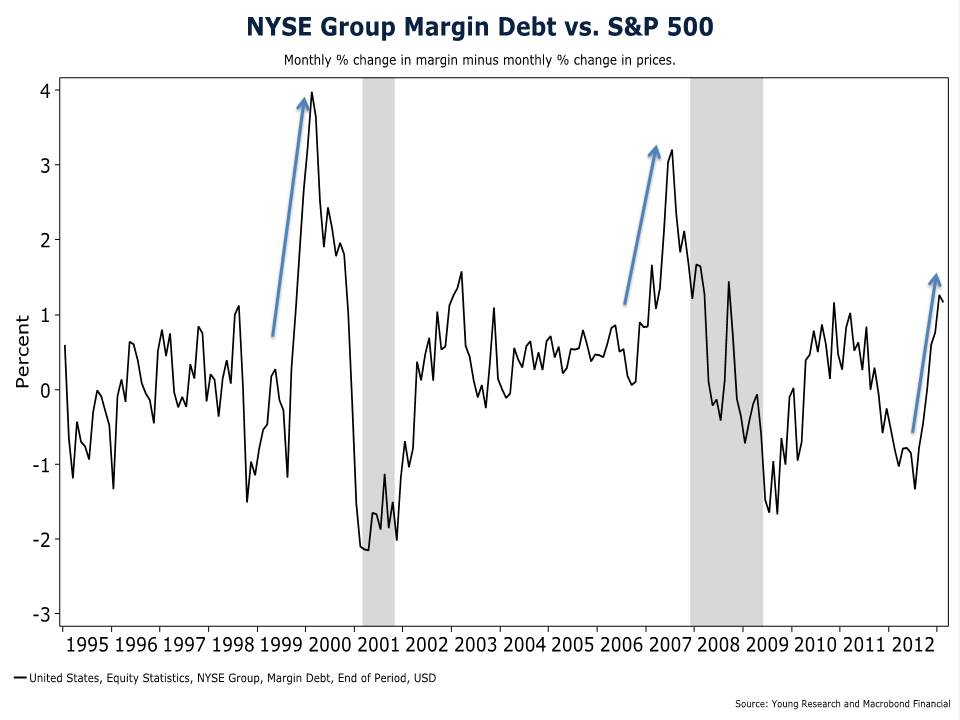

Today we’re seeing a similar pattern. In the second chart you can see the difference between the growth rates for margin and stock prices (monthly % change in margin minus monthly % change in prices). Both of the last two recessions were preceded by big spikes. Today a new spike is building rapidly. Caution is advised.

[/expand]