Value may be difficult to spot if you load your portfolio with market capitalization weighted exchange traded funds like those that track the S&P 500. Apple, Amazon, Facebook, Microsoft, and Google, the top five components of the S&P 500, trade at an average P/E of 84X and a median P/E of 29X earnings. One way to think about P/E is the number of years it would take to earn back your investment at the current rate of profit.

Worse than the elevated P/E of the S&P 500 and its top constituents is the average dividend yield of the top five. America’s five biggest companies pay an average yield of 0.64%. The median yield is 0% as only two of the five even bother with dividends.

It’s hard to make an argument that your S&P 500 ETF offers value when staring at a P/E of 84 and a dividend yield of 0.64%. The good news for long-term value-oriented investors is that the public’s obsession with capitalization weighted ETFs—and especially FAANG stocks—is that pockets of value are beginning to open in certain areas of the market.

Where are the pockets of value?

Follow the hot money and move in the opposite direction. Over recent years, the low interest rate environment created a chase for yield in dividend stocks that were viewed as “bond substitutes.” That drove down yields and created an uncomfortable correlation between long-term interest rates and these “bond substitutes.”

The hot money now appears to be leaving that trade.

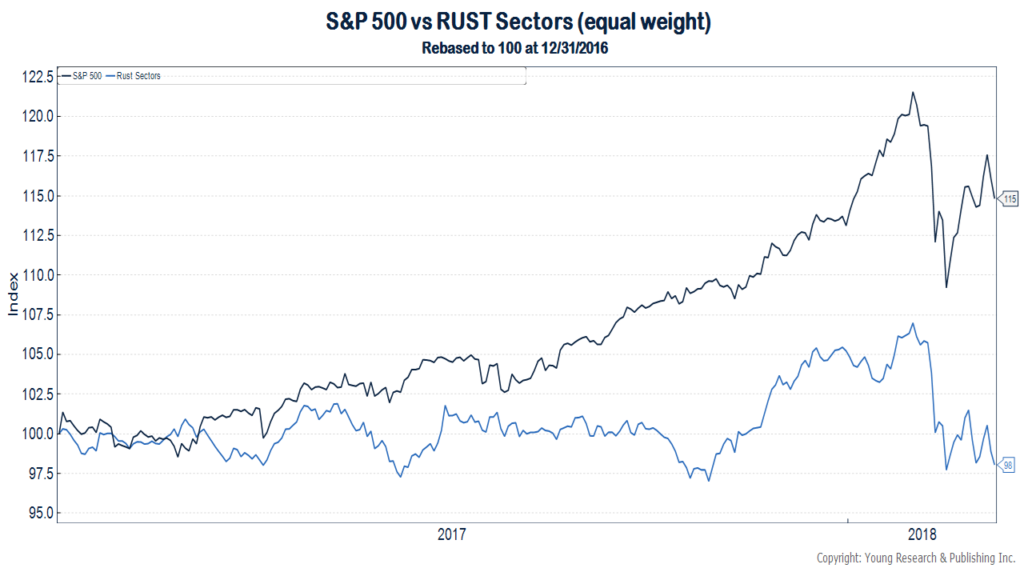

The highest yielding sectors of the stock market are all down YTD. The FAANG heavy consumer discretionary and technology sectors have managed to keep the S&P 500 in the black. If you want to find value, I would suggest that you start picking through real estate, utilities, consumer staples, and telecom stocks (the RUST Sectors). That’s where we’re looking.